The High-Speed Datacom Communications and Connectivity Market – 2017 and Beyond

| Report Number: P-910-17 |

Price:

$3950.00

|

| Publication Date: June 2017 |

This is invisible

Is Your Company Prepared

as 100G Expands in the Gigabit Market?

This report analyzes:

- What the shift to 40/100G means to the data center operator and the role that Fibre Channel and InfiniBand will play in this shift.

- How top-of-rack (ToR) switching is affecting the network infrastructure.

- Provides a detailed assessment of the key connector and cable assemblers in this market – Bel Connectivity, CommScope, Corning, Telegärtner, and many others – their current and anticipated products and how they compare with mega connector and cable assembler’s like Amphenol, Molex and TE Connectivity.

Be ready to move your company into this new era of cable and connectivity, order your copy of this report today.

This is invisible

The High-Speed Datacom Communications and Connectivity Market – 2017 and Beyond

Executive Summary

- The Overall High-Speed Datacom Network Connectivity Market

- Table ES-1 – Data Communications Connectors and Cable Assemblies Sales by Equipment Category

- Table ES-2 – Total Ethernet Connectors and Cable Assemblies by Data Rate

- Figure ES-1 – Ethernet Connectors and Cables by Data Rate 2017 and 2022

- Figure ES-2 – Ethernet Connectors and Cables by Data Rate

- Table ES-3 – Total Ethernet Connectors and Cable Assemblies by Product Types

- Figure ES-3 – Breakdown of Ethernet Connectors and Cables by Market

- Gigabit Ethernet Still a Volume Application

- 10-Gigabit Ethernet Largest Revenue Opportunity

- Figure ES-4 – 10G Interconnect Product Revenue

- 25G Ethernet as the New Server Connection

- Figure ES-5 – 25G Connectors and Cables

- 40/100G Ethernet

- Figure ES-6 - 40/100G Connectors and Cable Assemblies Forecast

- Fibre Channel and InfiniBand

- Figure ES-7 – Fibre Channel Connectors and Cables

- Figure ES-8 – InfiniBand Connectors and Cables

- High-Speed Datacom Connectivity Vendors

- Table ES-4 - High-Speed Data Communications Connector and Cable Assembly Top Suppliers and Products

Chapter 1 – Introduction

- Introduction

- Background

- The High-Speed LAN and DC Evolution

- Figure 1 – Ethernet Data Rate Evolution

- Scope and Objectives

- Scope of this Report

- Connector and Cable Assemblies Covered

- Methodology and Information Sources

- Plan of Report

Chapter 2 – Network Equipment Market and Connectivity Trends

- Introduction

- Ethernet

- Table 2-1 – Data Communications Ethernet Variants 1G and Beyond

- Table 2-2 – Wide Area Neatwork Data Rate Progression

- Table 2-3 – Local Area Network and Enterprise Data Center Data Rate Progression

- Ethernet Servers and Switches

- Storage Area Networks and Fibre Channel

- Table 2-4 – Fibre Channel Device Data Rate Roadmap

- Table 2-5 – Fibre Channel ISL Data Rate Roadmap

- High Performance Computing (HPC) and InfiniBand

- Figure 2-5 – Today’s Supercomputer

- Table 2-6 – InfiniBand Formats and Data Rates

- Figure 2-6 – InfiniBand Roadmap

- Ethernet versus Fibre Channel and InfiniBand

- Figure 2-7 – Top 500 HPC Systems by Interconnect

- Mobile Backhaul

- 4G, LTE, LTE-Advanced

- Figure 2-8 – Mobile Phone Network Technology Progression

- 3GPP LTE and LTE-Advanced

- Figure 2-9 – Network Solutions from GSM to LTE

- 4G to 5G

- Figure 2-10 – Huawei’s Vision of the Mobile Network to Support 5G

- Figure 2-11 – Mobile Network Evolution Roadmap

- The Mobile Backhaul Network

- Figure 2-12 – Mobile Anyhaul Network to Support 5G

- New Technologies to Support 4G and Beyond

- Market Opportunities for LTE

- Figure 2-13 – LTE Networks

- Gigabit Datacom Connector and Cable Assembly Products

- 1G, 10G, 25G, and 40G Copper – RJ45 Family

- Figure 2-14 – Category 6 UTP Jack for Patch Panels

- Figure 2-15 – Category 6 Plugs, Patch Cords, and Patch Panels

- Figure 2-16– Category 6A Modular Jack

- Figure 2-17– Category 6A Shield Modular Plug and Cable Assembly

- Figure 2-18 – Siemon Company TERA™ Connector

- Figure 2-19 – Nexans GG45 Connectors

- Figure 2-20 – Bel Stewart’s ARJ45® Connectors

- Figure 2-21 – Category 8 F/UTP Jack for Patch Panels

- Figure 2-22 – Category 8 Patch Cords, Patch Panel Connector and Cable

- 1G/10G/25G – SFP Family

- Figure 2-23 – SFP+ Direct Attach Copper Cable Assembly

- Figure 2-24 – 20-Position SFP Board Connector, Cages, and DAC

- Figure 2-25 – SFP28 Optical Module

- Pre-terminated Fiber Assemblies

- Figure 2-26 – Examples of Patch Cords and Pre-terminated Assemblies

- Figure 2-27 – 4-Connector End-to-End Fibre Channel Connection

- Figure 2-28 – Harness Assemblies for a Brocade 48000 Switch in a Data Center

- Figure 2-29 – Fiber-Optic Trunk Cable with Pulling Eye

- Figure 2-30 – MPO End Face

- Figure 2-31 – MPO Key and Marking

- Figure 2-32 – Side View Cut-away of Cassette MPO Connection

- Figure 2-33 – MPPO Connector End Face within Cassette

- Figure 2-34 – TIA-568C Method A Polarity

- Figure 2-35 – TIA-568C Method B Polarity

- Figure 2-36 – TIA-568C Method C Polarity

- 40G QSFP10 Family

- Figure 2-37 – Amphenol FCI’s QSFP10 DAC

- Figure 2-38 – Finisar’s QSDP10 Module and Berk-Tek’s Fiber Cable

- Figure 2-39 – Molex’s QSFP10 38 Position Board Mount Mating Connector

- Figure 2-40 – MPO Cable Connector

- Figure 2-41 – Avago Technologies QSFP10 AOC

- 100G CXP Family

- Figure 2-42 – CXP Board-mount connectors with cage, DAC and Fiber Assembly

- Figure 2-43 – Board-mount integrated mating connector

- Figure 2-44 – Avago Technologies’ CXP Optical Module

- Figure 2-45 – Avago Technologies CXP AOC

- 100G CFP Family

- Figure 2-46 – TE Connectivity CFP Hardware

- Figure 2-47 – Reflex Photonics CFP Module

- Figure 2-48 – FIT’s CFP2 Module

- Figure 2-49 – CFP2 Module Plug Connector Assembly

- Figure 2-50 – Fujitsu OCs CFP4 Module

- Figure 2-51 – CFP4 Module Plug Connector

- 100G QSFP28 Family

- Figure 2-52 – ColorChip QSFP28 Module

- Figure 2-53 – QSFP28 Hardware

- 100G CPAK Family

- Figure 2-54 – Cisco CPAK Module

- 400G CDFP Family

- Figure 2-55 – CDFP Form Factor

- Figure 2-56 – CDFP Host Connector, Heat Sink and Cage

- 400G CFP8 Family

- Figure 2-57 – CFP8 Transceiver

- Figure 2-58 – 124 Pin CFP8 Plug Connector

- Figure 2-59 – 124 Pin CFP8 Host Board-Mount Connector

- Other 400G Solutions – QSFP-DD and OSFP

- Figure 2-60 – QSFP-DD Form Factor

- Figure 2-61 – Connector Detail for the QSFP-DD

- Figure 2-62 – OFSP Form Factor for 400G

- On-Board Optics

- Figure 2-63 – MXC versus MTP Connector

Chapter 3 – Competitive Landscape

- Introduction

- 3M

- Table 3-1 – 3M’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Amphenol

- Table 3-2 – Amphenol’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Belden Table 3-3 – Belden’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Bel Connectivity

- Table 3-4 – Bel Connectivity’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- CommScope

- Table 3-5 – CommScope’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Corning

- Table 3-6 – Corning’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Foxconn Interconnect Technology (FIT)

- Table 3-7 – FIT’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Molex

- Table 3-8 – Molex’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- The Nexans Group

- Table 3-9 – Nexans’ Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Panduit

- Table 3-10 – Panduit’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Siemon

- Table 3-11 – Siemon’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- TE Connectivity

- Table 3-12 – TE Connectivity’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Telegärtner

- Table 3-13 – Telegärtner’s Gigabit-to-400G HS Data Communications Connector and Cable Assemblies Offering

- Others

Chapter 4 – Five-Year Forecasts

- Introduction

- Total Market

- Table 4-1 - Data Communications Connectors and Cable Assemblies - Sales by Equipment Category 2017 through 2022

- Table 4-2 – Regional Percentages for Data Communications Connectors and Cable Assemblies 2017 through 2022

- Table 4-3 – Data Communications Connectors and Cable Assemblies Sales by Region 2017 through 2022

- Figure 4-1 – 2017 Data Communications Connectors and Cable Assemblies Sales by Region

- Figure 4-2 – 2022 Data Communications Connectors and Cable Assemblies Sales by Region

- Figure 4-3 – Data Communications Connectors and Cable Assemblies 2017 through 2022 Sales by Region

- Table 4-4 – Ethernet Connectors and Cable Assemblies Sales by Region 2017 through 2022 with 5-Year CAGR

- Table 4-5 - Fibre Channel Connectors and Cable Assemblies Sales by Region 2017 through 2022 with 5-Year CAGR

- Table 4-6 – InfiniBand Connector and Cable Assemblies Sales by Region 2017 through 2022 with 5-year CAGR

- Figure 4-4 – Ethernet, Fibre Channel & InfiniBand Sales 2017 through 2022

- Total Ethernet Enterprise Products

- Ethernet Structured Cabling Market

- Table 4-7 – Ethernet Structured Cabling Components by Data Rate 2017 though 2022

- Table 4-8 – Ethernet Structured Cabling Components by Product Type 2017 through 2022

- Table 4-9 – Ethernet Copper Structured Cabling Components 2017 through 2022

- Table 4-10 – Ethernet Fiber Structured Cabling Components 2017 through 2022

- Figure 4-5 – Ethernet Copper vs. Fiber Structured Cabling Components 2017 through 2022

- Ethernet Interconnect Market

- Table 4-11 – Ethernet Interconnect Components by Data Rate 2017 through 2022

- Table 4-12 – Ethernet Interconnect Components by Product Type 2017 through 2022

- Table 4-13 – Ethernet Interconnect Connectors by Data Rate 2017 through 2022

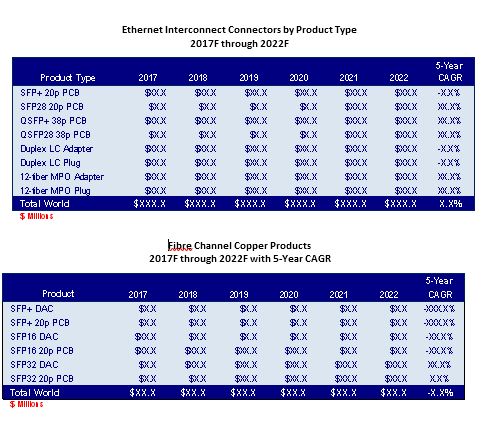

- Table 4-14 – Ethernet Interconnect Connectors by Product Type 2017 through 2022

- Table 4-15 – Ethernet Interconnect Cable Assemblies by Data Rate 2017 through 2022

- Table 4-16 – Ethernet Interconnect Cable Assemblies by Product Type 2017 through 2022

- Table 4-17 – Ethernet Interconnect Copper Connectors by Data Rate 2017 through 2022

- Table 4-18 – Ethernet Interconnect Copper Connectors by Product Type 2017 through 2022

- Table 4-19 – Ethernet Interconnect Fiber Connectors by Data Rate 2017 through 2022

- Table 4-20 – Ethernet Interconnect Fiber Connectors by Product Type 2017 through 2022

- Table 4-21 – Ethernet Interconnect Copper Cable Assemblies by Data Rate 2017 through 2022

- Table 4-22 – Ethernet Interconnect Copper Cable Assemblies by Product Type 2017 through 2022

- Table 4-23 – Ethernet Interconnect Fiber Cable Assemblies by Data Rate 2017 through 2022

- Table 4-24 – Ethernet Interconnect Fiber Cable Assemblies by Product Type 2017 through 2022

- Table 4-25 – Ethernet Interconnect Copper Components 2017 through 2022

- Table 4-26 – Ethernet Interconnect Fiber Components 2017 through 2022

- Ethernet Wireless Backhaul Products – Connectors

- Table 4-27 – Ethernet Wireless Backhaul Connectors by Data Rate 2017 through 2022

- Table 4-28 – Ethernet Wireless Backhaul Connectors by Product Type 2017 through 2022

- Table 4-29 – Ethernet Wireless Backhaul Copper Connectors by Data Rate 2017 through 2022

- Table 4-30 – Ethernet Wireless Backhaul Copper Connectors by Product Type 2017 through 2022

- Table 4-31 – Ethernet Wireless Backhaul Fiber Connectors by Data Rate 2017 through 2022

- Table 4-32 – Ethernet Wireless Backhaul Fiber Connectors by Product Type 2017 through 2022

- Figure 4-6 – Ethernet Wireless Backhaul Copper vs Fiber Connectors 2017 through 2022

- Ethernet Wireless Backhaul Products – Cable Assemblies

- Table 4-33 – Ethernet Wireless Backhaul Cable Assemblies by Data Rate 2017 through 2022

- Table 4-34 – Ethernet Wireless Backhaul Cable Assemblies by Product Type 2017 through 2022

- Table 4-35 – Ethernet Wireless Backhaul Copper Cable Assemblies by Data Rate 2017 through 2022

- Table 4-36 – Ethernet Wireless Backhaul Copper Cable Assemblies by Product Type 2017 through 2022

- Table 4-37 – Ethernet Wireless Backhaul Fiber Cable Assemblies by Data Rate 2017 through 2022

- Table 4-38 – Ethernet Wireless Backhaul Fiber Cable Assemblies by Product Type 2017 through 2022

- Figure 4-7 – Ethernet Wireless Backhaul Copper vs Fiber Cable Assemblies 2017 through 2022

- Fibre Channel

- Table 4-39 – Fibre Channel Products by Data Rate 2017 through 2022

- Figure 4-8 – Fibre Channel Products by Data Rate 2027 through 2022

- Table 4-40 – Fibre Channel Products by Product Type 2017 through 2022

- Table 4-41 – Fibre Channel Copper Products 2017 through 2022

- Table 4-42 – Fibre Channel Fiber Products 2017 through 2022

- Figure 4-9 – Fibre Channel Copper vs Fiber Products 2017 through 2022

- InfiniBand Connectivity Market

- Table 4-43 – InfiniBand Products by Data Rate 2017 through 2022

- Table 4-44 – InfiniBand Products by Product Type 2017 through 2022

- Table 4-45 – InfiniBand Copper Products 2017 through 2022

- Table 4-46 – InfiniBand Fiber Products 2017 through 2022

- Figure 4-10 – InfiniBand Fiber vs Copper Products 2017 through 2022

- Introduction

- The Overall Multi-Gigabit Datacom Network Connectivity Market

- Data Communications Connectors and Cable Assemblies – Sales by Equipment Category

- Total Ethernet Connectors and Cable Assemblies by Data Rate

- Ethernet Connectors and Cables by Data Rate 2015 and 2019

- Ethernet Connectors and Cables by Data Rate 2014 through 2019

- Total Ethernet Connectors and Cable Assemblies by Product Type 2014 through 2019

- Breakdown of Ethernet Connectors and Cables by Product Type

- Gigabit Ethernet Still a Volume Application

- 10-Gigabit Ethernet Largest Revenue Opportunity

- SFP+ Connector Forecast

- SFP+ and Top of Rack (ToR) Data Center Architecture

- 40/100 Ethernet Marks a Shift to Parallel Technologies

- 40/100G Connectors and Cable Assemblies Forecast

- Fibre Channel and InfiniBand

- Fibre Channel Connectors and Cable Assemblies Forecast by Data Rate

- InfiniBand Connectors and Cable Assemblies Forecast by Data Rate

- Multi-Gigabit Datacom Connectivity Vendors

- Gigabit Data Communications Connectors and Cable Assemblies – Top Suppliers and Products

This is invisible

The High-Speed Datacom Communications and Connectivity Market – 2017 and Beyond

Bishop and Associates, Inc. has released a four-chapter research report providing a qualitative and quantitative analysis of the High-Speed Data Communications and Connectivity Market. The report covers connector and cable assembly sales forecasts for the years 2017 through 2022 by data communication equipment market, by data rate, by connector type, by medium (copper or fiber), and by cable assembly type. Forecasts are also broken out by region of the world.

The overall market for Gigabit and above connectors and cable assemblies in 2017 is expected to top $9.9 billion. The largest market by far is Ethernet. The largest growth in the next five years will come from 100G products with a CAGR of XX.X%, while the largest market will remain 10-Gigabit over the forecasting period. This is mainly due to its staying power in both corporate LANs and data centers. Gigabit Ethernet will see a decline in sales over the forecasting period with a CAGR of -X.X%.

This report provides a comprehensive overview by data rate (Gigabit, 10-Gigabit, 25-Gigabit, 40-Gigabit, and 100-Gigabit) of the three primary equipment types in data communications and cable assemblies; Ethernet Switch/Router, Fibre Channel Switch, and InfiniBand Switch.

Sample Tables:

In addition to product analysis, the report also offers a detailed overview of the competitive landscape of this market. Current and future product offerings of individual manufacturers are discussed, as well as how focused suppliers compare with mega connector and cable assembler’s like Amphenol, Molex and TE Connectivity.

Other key areas of discussion include:

- 25G Ethernet as the new server connection.

- What the shift to 40/100G means to the data center operator.

- What the future holds for Fibre Channel and InfiniBand.

- How top-of-rack (ToR) switching is affecting the network infrastructure.

Download a descriptive brochure here