PC, Tablet & Smartphone Market Analysis and Forecast 2015-2020

| Report Number: M-850-15 |

Price:

$3500.00

|

| Publication Date: December 2015 |

This is invisible

PC, Tablet & Smartphone Market Analysis and Forecast 2015-2020

In 2015, an Estimated 30 Billion Connectors were used in the Manufacturing of PCs, Tablets and Smartphones!

- Will PCs, tablets or smartphones show the most growth in units going forward? In connector sales dollars?

- Will the convergence of these three alter the mindset of the consumer, the manufacturer, the designer or the connector supplier?

- Which regions or countries are most likely to profit from this convergence? Which ones have the most to lose?

- Who were the manufacturing leaders in PCs, tablets, and smartphones?

- Are there potential new players on the horizon that could alter this present lineup?

- What type of affect will continued system integration, fewer I/O ports, and direct attach of CPU and DRAM have on the number of connectors used?

- What role will wearables, like the smartwatch play in this market?

This new report examines these issues, and other crucial elements pertinent to the growth and stability of these products. This report analyzes, by units and connector dollars, the impact the growth or demise of each of these products has on the connector industry. The report provides important information for anyone whose products, services or intellectual capacity touch these technologies. Be prepared for what the future holds, order your copy of PC, Tablet and Smartphone Market Analysis and Forecast 2015-2020.

This is invisible

PC, Tablet & Smartphone Market Analysis and Forecast-2015-2020

Table of Contents

Executive Summary

- Executive Summary

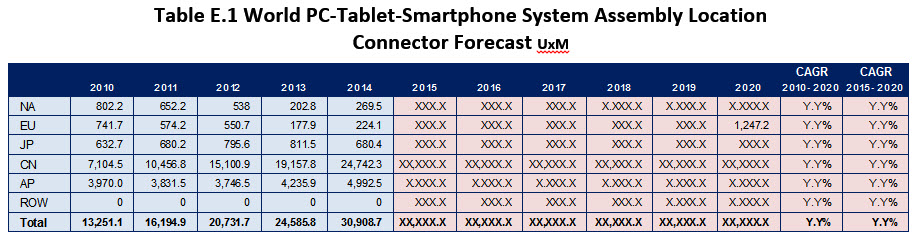

- Table E.1 World PC-Tablet-Smartphone System Assembly Location Connector Forecast

- World PC-Table-Smartphone System Assembly Forecast 2010-2025

Chapter 1 – Introduction

- Introduction

- About this Study

- Past/Present

- Table 1.1 High Leverage Items in 2015-2020 Forecasting

- Present/Future

- State of the Extended PC Marketplace

- Overall

- Observations

- Connector Industry

Chapter 2 – Smartphones, PDAs and other Body-Worn Devices

- Introduction

- PDAs Started it All

- Reasons

- Who Won?

- Worldwide Market Shares Smartphones

- Who “Lost” or had a “Learning Experience”?

- PDA Market Moved from Computers to Telecommunications

- Mobile/Smartphone Market

- All Phones

- Newer or Re-Packaged Entrants

- Table 2.1 Smartphone Shipments & Share 2012-2020

- Market Trends

- 2012 Smartphone Market Share Based on Units

- 2015 Smartphone Market Share Based on Units

- 2020 Smartphone Market Share Based on Units

- Table 2.2 Smartphone/Mobile Device Global Market Forecast (Units)

- All Mobile Device 2015 to 2020

- Apple versus Samsung

- Table 2.3 Bishop Estimate of Operating System Share of Mobile Phone Market, 2011-2015-2020

- Table 2.4 Mobile Phone Forecast 2010-2020 (Units)

- Table 2.5 Smartphone vs. Cell Phone Unit Volume 2010-20

- Mobile Phone OEMs

- Key Smartphone Design Features

- Market Direction/Dynamics

- Prediction: Smartphone Leaders for the 2010-20 Decade

- Leading Phones

- Qualcomm Mirasol Reflective Display Technology

- Mobile Phone/Palmtop Summary

- Connector Application Trends

- Where is this Going?

- The Smart Watch

- Conclusions

Chapter 3 – Tablets

- Overview and Definitions

- Tablet Leaders and Others

- Apple

- Asustek Computer

- Acer Inc

- Amazon.com

- Barnes & Noble

- Fujitsu Ltd

- Google Inc

- Lenovo

- Microsoft Inc

- Motorola

- Panasonic

- RIM, now Blackberry Ltd

- Samsung

- Sony

- Toshiba Corp

- Viewsonic Corp

- Vizio

- Dell

- Hewlett Packard

- Evolution of the Tablet

- Microsoft’s Late but Formidable Entry

- Key Tablet Players Include

- Market Forecast

- Table 3.1 World Forecast Tablet Devices 2010-20 Nominal

- Table 3.2 Nominal World Tablet Market 2010-20

- Table 3.3 Optimistic World iPad/Tablet Sales 2010-2020

- Table 3.4 Strong World Forecast including Microsoft

- Table 3.5 Current Forecast of Total Tablet Sales

- Table 3.6 Current Table Unit Sales by Manufacturer 2010-2015

- Table 3.7 Current Tablet Unit Sales Forecast 2010-2020

- Tablet Technology & Design

- Technology & Design Trends

- Difference between iPad, Android and Windows Tablets

- Under the Hood

- IPAD 3G Teardowns

- IPad 3 – 3G

- Samsung Galaxy Pad

- Google Nexus 9 Teardown

- Comments on Packaging

- Summary & Conclusions IPad/Tablet Computers

- Future?

- Which Operating System Will Win?

- Connector Trends

Chapter 4 – Personal Computers

- Introduction

- PC Players Today, in Rough Order of Units Sold

- Future of PC Business and its Supply Chain

- Connector Trends

- OEMS

- Lenovo

- Hewlett Packard

- Table 4.1 Greenpeace Ranking

- Table 4.2 PC Shipments by Product Category and Region

- Dell

- Apple

- Microsoft

- Future Applications

- For Connectors

Chapter 5 – Computational Background

- Introduction

- Table 5.1 Design Influences by Region

- Issues with these Numbers

- Table 5.2 Forecast: Smartphone System Assembly by Region 2010-20

- Chart 5.2a Smartphone System Assembly Connector Forecast 2010-20

- Table 5.3 Forecast: Smartphone System OEM Value by Region 2010-20

- Chart 5.3a Smartphone System OEM Value by Region 2010-20 Units

- Table 5.4 World Tablet Connector Forecast 2010-20 by System Assembly Location

- Chart 5.4a Tablet Assembly Location Connector Forecast 2010-20 Units

- Table 5.5 World Tablet Connector Forecast 2010-20 by OEM Production Value Location

- Chart 5.5a World Tablet OEM Production Value Location Connector Forecast 2010-20 Units

- Table 5.6 World Notebook Connector Forecast 2010-20 by System Assembly Location

- Chart 5.6a World Notebook System Assembly Connector Forecast

- 2010-20 Units

- Chart 5.6b Notebook OEM Production Value Connector Forecast 2010-20 Units

- Table 5.7 World Tower & Motherboard Connector Forecast by System Assembly 2010-20 Units

- Chart 5.7a Tower MoBo System Assembly Connector Forecast 2010-20 Units

- Table 5.8 PC Tower – MoBo Connector Forecast OEM Production Value

- Chart 5.8a Tower MoBo OEM Production Connector Forecast 2010-20 Units

- Table 5.9 World AIO System Assembly Location – Connector Forecast 2010-20

- Chart 5.9a World AIO System Assembly Connector Forecast 2010-20 Units

- Table 5.10 World AIO OEM Production Value Connector Forecast 2010-20

- Chart 5.10a World AIO OEM Production Value Connector Forecast 2010-20 Units

- Table 5.11 World PC-Tablet-Smartphone System Assembly Location Connector Forecast Units

- Chart 5.11a World PC-Tablet-Smartphone System Assembly Location Connector Forecast Units

- Table 5.12 World PC-Tablet-Smartphone System Assembly Location Connector Forecast Dollars

- Chart 5.12a World PC-Tablet-Smartphone System Assembly Location Connector Forecast Dollars

- Table 5.13 World PC-Tablet-Smartphone OEM Production Value Connector Forecast Units

- Chart 5.13a World PC-Tablet-Smartphone OEM Production Value Connector Forecast Units

- Table 5.14 World PC-Tablet-Smartphone OEM Production Value Connector Forecast Dollars

- Chart 5.14a World PC-Tablet-Smartphone OEM Production Value Connector Forecast Dollars

This is invisible

PC, Tablet & Smartphone Market Analysis and Forecast 2015-2020

Bishop and Associates, Inc. has released of a 5-chapter, 146-page research report providing an in-depth analysis of the worldwide PC, tablet and smartphone market. Covering the period 2015 through 2020, with detailed comparisons from 2010, this report focuses on the dynamic changes these markets have undergone as well as looks at the future potential in units and connectors.

The PC, tablet and smartphone markets have similar basic functionalities which, particularly in the consumer market segment, has led to confusion between devices, and a tendency to pare down use to the device that best fits one’s needs. For many that is a tablet or smartphone, not a PC. Thus, the venerable PC market, after many years of growth, particularly in the notebook sector, has hit a major speed bump. This change affects the connector industry, since these markets are major users of connector products: an estimated 30 billion units in 2015.

The report addresses a number of important areas that drive the success of this market and answer important questions, such as:

- Will the PC market begin to rise again?

- What does the future hold for tablets?

- How has the AIO affected this market?

- What is the impact of Microsoft tablets, smartphones and Windows 10?

Download a descriptive brochure here