5G Infrastructure

| Report Number: M-980-20 |

Price:

$5135.00

|

| Publication Date: September 2020 |

This is invisible

5G Infrastructure – How 5G is Impacting Infrastructure Hardware and Connector Buying Trends

The first wave of broadband changes is in-process and will impact the types of connectors used, who buys them, and how often. The impact will be felt in the mobile infrastructure and through the wireline carrier central office and traditional cable television equipment markets.

- How is the telecom industry breaking from the past to prepare for tomorrow? What role are industry groups playing in the implementation of 5G?

- How will the growing sophistication of radio area networks support connector industry growth?

- What fundamental changes are needed for service providers to profitably provide ongoing service improvements at a reasonable price?

- How will the accelerating adoption of software-defined open-source hardware platforms impact connector sales forecasts for proprietary equipment sets.

- How are mobile and fixed broadband networks being integrated onto shared hardware platforms?

Bishop & Associates newest research report, 5G Infrastructure – How 5G is Impacting Infrastructure Hardware and Connector Buying Trends provides insight as to how 5G and the hardware changes in-process will impact connector buying trends and a reference timetable for when they will be deployed. Timelines may move in or move out, but the significant changes outlined in this report will largely play out over the next five years.

This is invisible

5G Infrastructure – How 5G is Impacting Infrastructure Hardware and Connector Buying Trends

Table of Contents

Preface

- About this Report

Chapter 1 – Background

- Key Technical Attribute of 5G and Why They Are Important

- How 5G is being Implemented

- Seven Major Telecom Organizations Which Lead Development of New Mobile Telecom Standards

- 3GPP Market Representation Partners

- The Foundational Need for a Strong 4G-LTE Infrastructure

- Mobile Subscriptions by Technology (billions)

- 5G Will Enable Significant Growth in IoT Applications

Chapter 2 – Executive Summary

- How the Major Trends Related to 5G will Impact the Connector Market

- Major Background Issues and Trends

- Total market Includes: Server, Storage, Network, Rack, Power, Peripheral, and Other Revenue

- 2020 Total Market Value

- 2023 Total Market Value

- Projections from the Open Networking Forum

- Equipment Vendors

- Connector TAM for Open Source Hardware as a Percent of Active Rack-based Infrastructure Equipment

- 2020 Total TAM

- 2023 Total TAM

- Overall

- Focus on Broadband Access Equipment

- Chapter Summaries

- Chapter 3

- 2020-2025 Global Connector Revenue Trends for Key Radio Equipment Sets

- Chapter 4

- Chapter 5 Fixed Broadband Access Networks

- Chapter 6 Transport and Transmissions

Chapter 3 – Fronthaul Infrastructure

- From the Cell Station Antenna to the BBU or Distributed Unit

- Introduction

- The BBU has been Redefined to Increase Deployment Flexibility

- Hardware Overview and Key Terminology

- Large Radio Antenna

- RRU

- BBU

- Needed Spectrum will Define Hardware Deployment

- Trends in Cell Tower Architecture – The Long View

- How 5G is Impacting Connector use in Passive Antenna and RRUs

- The RF I/O Panel and the Key Trends in Passive Antenna Packaging

- Increased Miniaturization

- Multi-band RRU Use is Growing

- Hub Implementations

- From Passive to Hybrid to Advanced Active Antenna Systems

- Beam Steering Technologies for Passive Antenna

- Simple Active Antenna Units

- Active Antenna Systems using M-MIMO Technology

- Advanced Active Integrated Antenna Systems

- Connector Trends in Advanced Antenna Systems

- Small Cell Mobile Radio Networks

- Small Cell Antenna Enclosures

- RRU and BBU integration in Small Cells

- The Fronthaul Challenge

- Summary

- Key Connector Trends

- Global Connector Revenue Projections by Antenna Type

Chapter 4 – Backhaul Infrastructure

- From the DU or BBU through the Central Office

- Introduction

- Chapter 4 Focuses on Key Changes from the BBU (DU & CU) through the Central Office/Core

- The Changing Position of the BBU

- The Three Basic Types of RAN Architecture

- 4G and 5G Equipment Mix-and-Match Scenarios

- 5G-Stand-Alone Provides Critical Operator Control and Needed Efficiency

- 5G Specifications Build off Telco Drive for White Box Standards

- Upstream Content Providers are Key Partners for Mobile and Fixed Access Providers

- “OTT” Gaming and VR/AR Content Needs More Bandwidth & Reduced Latencies

- Service Operators Work with Datacom Special Interest Group to Promote White Box Solutions

- Primary Connector Interfaces in Backhaul Network

- Background

- Next-Gen Pluggable Form-Factors

- Smaller Size Fiber Optic Interfaces

- Summary Comments on Hardware Trends

Chapter 5 – Fixed Access Infrastructure

- From the Central Office to the Edge of the Subscriber Property

- Fixed Wireless Access Introduction

- Access Equipment in the Central Office

- PON Network Evolution

- Hybrid Fiber Coax (HFC) Access Networks

- Distributed Access Architecture (DAA)

- Will the Remote Access Node Become a Point of Network Convergence?

- Enter the Generic Access Platform (GAP)

- Summary HFC Equipment Trends

- Connector Market Implications

- Fixed Wireless Access (FWA)

- Introduction

- The Unique Challenges FWA Faces

- Wi-Fi and NexGenTV

- Summary Comments – Broadband Access

Chapter 6 – Network Transport and Microwave Radio Trends

- Introduction

- Transport Layer Equipment

- Critical Transport Layer Hardware Development Projects

- Microwave Backhaul Radio Equipment

- Introduction

- Key Mid and Long-Haul Connector Market Drivers

- Examples of Increasing Technical Efficiencies in Today’s

- Microwave Infrastructure

- How Microwave Radio Makers are Improving Their Technology

- How to Translate the Over-riding Trends into Connector Trends

Appendix 1 – Acronyms, Key Terms, and Definitions

Appendix 2 – Key Special Interest Groups and Standards Organizations

Appendix 3 – 4G-LTE, 5G Non-Standalone, and 5G Standalone – Partial 5G Upgrade Scenarios as Defined in the 3Gpp Release 15 Specs

Appendix 4 – CPRI, eCPRI, and Radio over Ethernet

This is invisible

5G Infrastructure – How 5G is Impacting Infrastructure Hardware and Connector Buying Trends

Written for connector manufacturers and channel partners, equipment vendors, and industry analysts, Bishop & Associates’ newest research report, 5G Infrastructure – How 5G is Impacting Infrastructure Hardware and Connector Buying Trends focuses on how broadband service providers are overhauling their infrastructure to provide for the next-gen use cases that are grabbing headlines.

The first waves of broadband infrastructure changes are in-process and already impacting the types of connectors used, who buys them, and how often. The impact is being felt in mobile infrastructure and through the wireline carrier central office and traditional cable television equipment markets. These networks are being converged. As the foundational changes needed for network convergence reach critical levels of implementation next-gen use cases will be ramping up. The first waves of infrastructure streamlining now in process will be a defining trend in broadband equipment connector purchasing through 2025.

The 5G Infrastructure report focuses on how the telecom industry is breaking from its past to prepare for tomorrow. 5G and the first wave of changes underway will introduce a new normal to the infrastructure connector market. Radio area networks will become increasingly sophisticated, and their ongoing evolution will support connector industry growth above 27% through 2025. Connector sales for the rack-based equipment used throughout the rest of the network will grow as well but at a lower rate. The differences here are partly due to the accelerating adoption of more efficient software-defined open-source hardware platforms to replace the proprietary equipment sets that prevail today. The open-source hardware sector of the market will grow at an accelerating pace through 2025.

For service providers to profitably provide a greatly expanded set of services at acceptable prices, they need to first transition to a simpler, more unified infrastructure. As significantly, they need to do it at a pace that makes business sense. Their platforms need to support existing subscribers and ongoing increases in bandwidth as well as be flexible enough to quickly address next-gen use cases. To this end, communication service providers are following the playbook used by the hyper-scale datacenters. The hyper-scalers improved their service flexibility and dramatically reduced costs by converting their voice, video, and data hardware onto unified software-defined hardware platforms based on IP-protocols. What differentiates the telecom industry challenges is that they are implementing these same changes across many hundreds of thousands of locations worldwide.

Projections for how the 5G infrastructure market will unfold vary dramatically. If you read the headlines, you might think it is here now. And people may buy their 5G phones tomorrow, but the anticipated service improvements will be incremental and introduced over time. New spectrum will be phased in over years. Radio networks will evolve in phases to provide added 4G-LTE support as well as support the introduction of new 5G services. The underlying networks will be modified to provide for more independent control interfaces.

Our forecasts are based on fundamental equipment trends and how they will impact connector value per equipment class at a strategic level. These are uncertain times. Currency exchange rates, spectrum auction timing, heightened political unrest, new disruptive technologies, and of course, the issues related to COVID-19 all impact predictions.

The report outline provides insight as to how 5G and the hardware changes in-process will impact connector buying trends and a reference timetable for when they will be deployed. Timelines may move in or move out, but the significant changes outlined in this report will largely play out over the next five years.

Chapter Summaries:

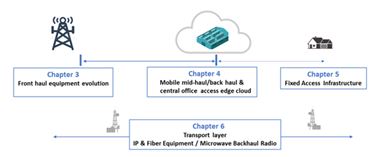

There are four chapters of more technical content to the report. Each covers a different segment of the communications service operator infrastructure. The focus in each section is on the primary equipment types, the transitions in progress, and how they will impact connector buying trends.

Download a descriptive brochure here