Mobile Backhaul Network Technologies and Connectivity Market

| Report Number: P-980-13 |

Price:

$3950.00

|

| Publication Date: October 2013 |

This is invisible

This 6 chapter research report covering mobile backhaul network discusses the technologies used in mobile backhaul network, equipment involved, and connectivity products needed to support these solutions.

This is invisible

Executive Summary

- Heterogeneous Backhaul Network

- New Backhaul Technologies to Support LTE and 4G

- Equipment and Connectivity for Mobile Backhaul

- Carrier Mobile Network

- Microwave Radio for Mobile Backhaul

- Multi-service Platform for Mobile Backhaul

- Carrier Ethernet Service Switch

- Mobile Backhaul Connectivity Supply and Market Opportunities

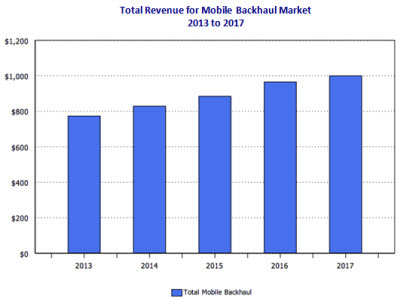

- Total Revenue for Mobile Backhaul Market 2013 to 2017

- Total Revenue by Application 2013 to 2017

- Total Fiber and Copper 2013 to 2017

- Total Copper Revenue by Category 2013 to 2017

- Total Revenue RF Connectors and Cables 2013 to 2017

- Conclusions

Chapter 1 - Introduction

- Background

- The Mobile Backhaul Network Market Defined

- Acronyms

- Wireless Network Migration

- How Consumer Behavior Drives the Mobile Network

- Scope and Objectives

- Mobile Backhaul Connectors and Cable Assemblies Covered

- Methodology and Information Sources

- Plan of Report

Chapter 2 – Mobile Backhaul Definitions

- Telecommunications/Data Communications Sector

- Enterprise Network Equipment - Wireless Network Equipment

- Wireline Carrier Network Equipment

- Cable/MSO Network Equipment

- Other Network Equipment

- Wireless Network Equipment

- Wireless Subscriber Equipment

- Cellular/PCS/Other Subscriber Equipment

- Other Wireless Subscriber Equipment

- Wireless Infrastructure Equipment

- Cell Site Apparatus

- Base Transceiver Stations (BTS)

- Base Stations Controllers (BCS)

- MSC Switch

- IP Soft Switches

- Radio Network Controllers (RNC)

- MSC Access

- MSC Media and Signaling Gateways

- Microwave Antennas

- Microwave Couplers/Duplexers

- Microwave Transceivers

- Microwave Power

- WLL Base Station Antenna (BSA)

- WLL Base Station Transceiver (BST)

- WLL Base Station Access

- WLL Residential Transceiver

- WLL Residential Gateway

- Other Wireless Equipment

- Wireline Network Equipment

- SONET/SDH Nodes

- SONET/SDH ADM

- WDM Equipment

- Core Routers

- Edge (Metro) Routers

- Digital Cross Connects

- Circuit Switches

- ATM Switches

- IP Switches & Gateways

- Optical Line Terminals (OLT)

- Optical Network Unit (ONU)

- Digital Loop Carrier (DLC) Equipment

- DSL/ASDL Equipment

- Channel Banks

- Multi-Service Access

- Other Access

- 1GbE/10GbE Nodes

- 10/100 MbE Nodes

- Outside Plant (OSP) Apparatus

- Other Wireline Equipment

- Telecommunications Equipment Types and Technologies

- Regions of the World

Chapter 3 – Mobile Backhaul Technology and Market Drivers

- Mobile Devices

- Current Network Baseline

- Mobile Network Supply vs. Demand

- The Variations of 3G and 4G Driving Mobile Backhaul Network Evolution

- 3G Technologies

- 4G Technologies

- Diagram of an LTE Network

- Wi-Max Network

- Evolution from GSM to LTE

- LTE Rollouts to Address Consumer Needs

- 4G LTE Global Availability

- 4G LTE Worldwide Commercial Network Launches

- 4G LTE Global Infrastructure Revenues

- 4G LTE Devices

- 4G LTE Speeds

- 4G LTE Subscriptions

- Consumer 4G Perception

- Addressing the Backhaul Network

- Alcatel-Lucent Mobile Backhaul Solution Architecture

- Integrated Wireless Backhaul and Wireline Network

- Alcatel-Lucent’s Mobile Network Access Equipment Options

- Alcatel-Lucent’s Wireline Access for Small Cell Backhaul

- Network Equipment and Connectivity

- The Mobile Backhaul Network

- TDM and ATM PWE3 Backhaul with Layer 2 Interworking

Chapter 4 – Mobile Operators and Equipment Manufacturers Perspectives

- Mobile Operators

- America Movil

- Mobile Backhaul Network from Alcatel-Lucent

- AT&T Mobility

- AT&T’s First Cellular Telephone Schematic

- AT&T’s Progression of Mobile Backhaul Networks

- Bharti Airtel

- Japanese Connector Market by End-Use Equip. - Percent of Total by Year & Equip. Sector

- Alcatel-Lucent’s IP/MPLS Mobile Backhaul Solution

- China Mobile

- O2/Telefonica

- Telefonica History

- Verizon Wireless

- Alcatel-Lucent’s End-to-End Mobile Network Solution

- Vodafone

- Vodafone Services Map

- Fixed-only Telephone Providers

- British Telecom

- CenturyLink

- CenturyLink Switched Ethernet Network

- Colt Telecom

- Colt’s Fiber Network

- Colt’s Proposed Mobile Backhaul Model

- Level 3 Communications

- Level 3 Fiber Network

- TeliaSonera International Carrier

- TSIC’s U.S. Network

- TSIC’s European Network

- TSIC’s Asia Network

- Cable Operators (MSOs)

- Comcast

- Comcast Business Backbone/Backhaul Cloud

- Comcast Fiber Network

- Virgin Media Business/Liberty Global

- Mobile Network Equipment Manufacturers

- Adtran, Inc.

- Adtran’s Carrier Solution

- Adtran’s Ethernet over Fiber Solution

- Adtran’s Total Access 5000 Series

- Alcatel-Lucent

- Alcatel-Lucent Mobile Backhaul Infrastructure for Heterogeneous Networks

- Alcatel-Lucent IP/Ethernet Small Cell In-Building Aggregation and Backhaul Solution

- Alcatel-Lucent’s Packet Microwave and IP/MPLS Backhaul

- Ciena

- Ciena’s Carrier Ethernet Architecture for Mobile Backhaul

- Example of Carrier Ethernet for 2G, 3G and 4G Network

- Ciena’s Mobile Backhaul 3900 Series Access Switches for Carrier Ethernet

- Ciena’s Service Delivery Switches for Mobile Backhaul

- Ciena’s Service Aggregation Switches for Mobile Backhaul

- Ciena’s 5100 Aggregation Switches

- Ceragon Networks

- Ceragon’s FibeAir Deployment Options

- Ceragon’s FibeAir IP-10 G-series Integrated Wireless Backhaul Solution

- Scalability of the FibeAir IP-10 Solution

- Cisco Systems

- Cisco Prime for Managing Unified RAN Backhaul

- Cisco’s MWR 2941 Mobile Wireless Router

- LTE/EPC Layer 3VPN Connectivity Options

- DragonWave

- Hybrid Cellular Network Using DragonWave Horizon Products

- DragonWave’s Horizon Quantum Radio and Hub

- Ericsson

- Ericsson’s MINI-LINK SP 110

- Ericsson’s Network Vision

- Ericsson’s SPO 1400 Packet Optical Transport Platform

- Huawei Technologies Co., Ltd

- Huawei CK600-X2-M16 Metro Services Platform

- Tellabs

- Tellabs Smart Service Assurance Framework

- Technology Choices Using Tellabs Solution

- Physical Media Supported by Tellabs Solutions

- Tellabs 8000 Intelligent Network Manager

- Tellabs 8611 SmartRouter

Chapter 5 – Connector Suppliers

- 3M

- 3M’s Single Mode LC Plug

- 3M’s Fiber Terminal

- 3M’s Fiber Distribution Unit

- Amphenol

- Cross-section of Amphenol’s Mobile Backhaul Offerings

- Amphenol’s Modular Jack (RJ45)

- SFP Connector and Cage

- Wall-mount Enclosure with Fiber Patch Cords and Adapters

- CommScoper

- Category 6A Patch Cord Cable Assembly

- N-type Connector

- LC Duplex Plug (Cable) Connector

- High Performance Parabolic Shielded Antenna

- Corning Cable Systems

- ONE Wireless Platform System Architecture

- FutureCom S/FTP Category 7 Indoor/Outdoor Cable

- Category 6A Patch Panel Jack

- LC Duplex Adapters

- Corning’s Fiber Patch Cords

- FCI

- SFP DAC,Cage and Board Mount Connectors

- SFP+ Optical Module

- Duplex LC Adapters

- Foxconn (Hon Hai)

- Foxconn’s Modular Jack Board-Mount Connectors

- Category 6 Patch Cords

- SFP+ Cage

- SFP+ PCB Connector

- Hirose Electric

- Category 6 RJ45 Jack and Cable Assembly

- N-type Connectors and Cable Assembly

- Huber+Suhner

- N-type Connectors and Cables

- Fiber-optic Enclosure

- LC-XD Connector

- Q-XCO SFP Connector

- Molex

- Molex’s SFP+ Family

- Molex Premise Networks’ PowerCAT 6A Shielded RJ45 Jack

- LC Solutions

- Sealed SFP Assemblies

- Rosenberger

- Broad Life of RF Products

- Quick-Lock N Connectors

- LC Products

- TE Connectivity

- Shielded Category 6A Solution

- Category 7A Modular Jack

- SFP+ Connectivity Product Family

- N-type Connector

- Duplex LC Plug Connectors

- Telegartner

- Category 6A Patch Cords

- Category 6A RJ45 Shielded Jack

- RF Connectors Including N-type

- Telecommunications Outdoor Connectors (TOC) IP68

- Fiber-optic Distributors and Splice Boxes

Chapter 6 – Market Statistics and Five-Year Forecasts

- Mobile Backhaul Equipment Market 2013 and 2017

- Connectors by Product Type 2010 to 2017 with Percent Change and 5-Year CAGR

- Connectors by Product Type 2012

- Connectors by Product Type 2017

- Cable Assemblies by Product Type 2010 to 2017 with Percent Change and 5-Year CAGR

- Cable Assemblies by Product Type 2012

- Cable Assemblies by Product Type 2017

- 2010 to 2017 Connector Sales by Product Type with Percent Change and 5-Year CAGR – Category 5

- 2010 to 2017 Connector Sales by Product Type with Percent Change and 5-Year CAGR – Category 5e/6

- 2010 to 2017 Connector Sales by Product Type with Percent Change and 5-Year CAGR – Category 6A/7

- 2010 to 2017 Connector Sales by Product Type with Percent Change and 5-Year CAGR – SFP+

- 2010 to 2017 Connector Sales by Product Type with Percent Change and 5-Year CAGR – LC

- 2010 to 2017 Connector Sales by Product Type with Percent Change and 5-Year CAGR – N-Type

- 2010 to 2017 Connector Sales by Media Type with Percent Change and 5-Year CAGR – Copper Connectors

- Total Copper Connectors 2010 to 2017

- 2010 to 2017 Connector Sales by Media Type with Percent Change and 5-Year CAGR – Copper Cable Assemblies

- Total Copper Assemblies 2010 to 2017

- 2010 to 2017 Connector Sales by Media Type with Percent Change and 5-Year CAGR – Fiber Connectors

- Total Fiber Connectors 2010 to 2017

- 2010 to 2017 Connector Sales by Media Type with Percent Change and 5-Year CAGR – Fiber Assemblies

- Total Fiber Assemblies 2010 to 2017

- Total Copper versus Fiber Assemblies 2010 to 2017

- Total Copper versus Fiber Connectors 2010 to 2017

- Ethernet Sales by Region 2010 to 2017 with Percent Change and 5-Year CAGR

- Fast/Gigabit Ethernet Sales by Region 2010 to 2017 with Percent Change and 5-Year CAGR

- 10-Gigabit Ethernet Sales by Region 2010 to 2017 with Percent Change and 5-Year CAGR

- TDM (E1/T1) by Region 2010 to 2017 with Percent Change and 5-Year CAGR

- Total Copper and Fiber Connectors by Region 2010 to 2017 with Percent Change and 5-Year CAGR

- 2012 Copper and Fiber Connectors by Region

- 2017 Copper and Fiber Connectors by Region

- Total Copper and Fiber Cable Assemblies by Region 2010 to 2017 with Percent Change and 5-Year CAGR

- 2012 Total Copper and Fiber Assemblies by Region

- 2017 Total Copper and Fiber Assemblies by Region

- Connectors by Ethernet Data Rate

- Cable Assemblies by Ethernet Data Rate

- Products by Ethernet Data Rate – SFP+ DAC Cable Assemblies

- Products by Ethernet Data Rate – SFP+ 20p PCB Connector

- Products by Ethernet Data Rate – LC Connector and Patch Cord

This is invisible

Wireless networking of all types — cellular, LAN, WAN, WiFi, and satellite — is undergoing a period of transition. While it took more than five years for cellular sites to be upgraded from 2G to 3G, it appears that the conversion from 3G to 4G or LTE will be much shorter. In 2011, Verizon claimed that the changeover would happen before the end of 2012. That was a bit optimistic given the current economic conditions, but Verizon, and its largest rival AT&T, have made great strides in installing 4G-LTE. There are many more factors driving this upgrade than there were in play when 3G was being deployed. Smartphones were just coming onto the scene, and the tablet computer had not yet been invented. Now these devices are everywhere and their users want to be connected all the time, which has put a tremendous burden on aging 3G networks.

Since the release of the SmartPhone and the tablet, mobile networks have seen an ever-increasing need for better data handling. Thus, we have seen the progression from 2G to 3G and now to 4G-LTE. While all of these new front-end technologies are great, they have pushed the bottleneck into the backhaul network. So now mobile users can connect to the wireless tower quickly, but the data gets stuck in the queue at the base-station, where there may be a Gigabit Ethernet connection handling 100’s (in some cases perhaps 1,000’s) of data requests.

Carriers are addressing the need to enhance mobile backhaul networks in several ways, depending on where they are in the world and how many subscribers they cover. Solutions range from pico-cell microwave transmission to Carrier Ethernet-over-fiber.

Overall revenue for connectivity products sold into the mobile backhaul market is set to reach nearly $1 billion in 2017, as shown in chart below. This report discusses the varying technologies being used in mobile backhaul networks, the equipment involved, and the connectivity products needed to support these solutions.

Download a descriptive brochure here