World Military Market for Connectors

| Report Number: M-990-12 |

Price:

$5285.00

|

| Publication Date: January 2012 |

This is invisible

This report provides a quantitative analysis of the World Military Connector Market. This 16 chapter, 315-page research report identifies current major military programs and future applications with high growth potential, and provides a breakdown of the market value for connectors by region, by type, and wherever possible, by application.

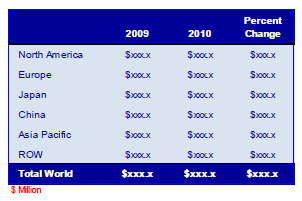

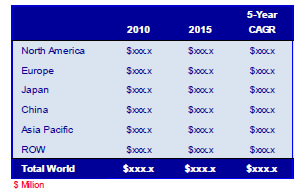

Connector sales and forecasts are presented for the years 2009, 2010, and 2015.

This is invisible

Chapter 1 - Objectives, Scope and Methodology

- Objectives and Scope

- Military Market Segments

- Methodology

- Regional Markets

Chapter 2 - Military Market Overview

- Military Market Overview

- Military Expenditure

- Defense Spending – Top 15 Countries in 2010

- Defense Spending – Top 15 Countries in 2010 (by Percentage Share)

- Market Drivers

- Market Challenges

- Arms Production

- Top 10 Arms Producing Companies

- World Nuclear Forces

- Regional Military Market Activity

- North America

- Europe

- Japan

- China

- Asia-Pacific

- Rest of World (ROW)

- Global Outlook

- Forward-looking Trends

Chapter 3 - Military Market Analysis

- Military Market Analysis

- Total World and Military Market Connector Sales 2010–2015

- Connector Statistics for the Military Market 2009-2010

- World 2009 and 2010 Military Connector Sales by Region

- 2010 World Military Connector Sales by Region

- World 2009 and 2010 Military Connector Sales by Region with Percent Change

- World 2011F Military Connector Sales by Region

- World 2010 and 2011F Military Connector Sales by Region with Percent Change

- Connector Statistics for the Military Market 2010-2015

- World 2010 and 2015 Military Connector Sales by Region

- 2015 World Military Connector Sales by Regional Share

- World 2010 and 2015 Military Connector Sales by Region

- World 2010 and 2015 Military Connector Sales by Region with 5-Year CAGR

- Regional Outlook

- North America Military Connector Sales 2010-2015

- Europe Military Connector Sales 2010-2015

- Japan Military Connector Sales 2010-2015

- China Military Connector Sales 2010-2015

- Asia-Pacific Military Connector Sales 2010-2015

- ROW Military Connector Sales 2010-2015

- The Military Market for Cable Assemblies

- Military Market for Cable Assemblies 2010-2015

- Military Market for Cable Assemblies Market Share for 2010-2015

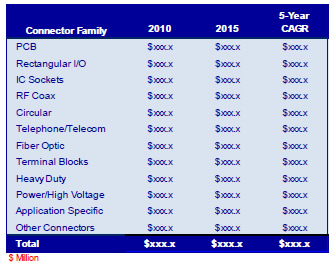

- Military Market by Product Type 2010-2015

- Trends and Comments by Cable Assembly Type

Chapter 4 - United States Military Market

- U.S. Military Budget

- U.S. FY2012 Proposed Budget Summary, by Component

- U.S. FY2012 Proposed Budget Summary, by Appropriation Title

- FY2012 Major Weapon Systems Procurement Budget

- Summary of the U.S. DoD FY2012 Budget Proposal

- Taking Care of People

- Rebalancing and Enhancing Military Capabilities

- Focus on Current War Efforts

- Modernizing for Future Conflicts

- Efficiencies and Reforms

- Supporting Troops in the Field

- UPDATE to the U.S. FY2012 Defense Authorization Bill

- Additional FY2012 Defense Budget Information (by Service Component)

- U.S. Navy FY2012

- U.S. Air Force FY2012

- U.S. Army FY2012

- NASA FY2012

Chapter 5 - European Military Market

- Overview

- Europe as a Combined Entity

- Recent European Military Market Activity

- France

- Germany

- Italy

- United Kingdom

- European Military Market Outlook

- European Military Connector Market

- End-use Equipment Share of the Connector Market 2010: Europe vs. Global

- Connector Sales in the European Military End-use Equipment Sector, by Country, 2005-2010

- Connector Sales in the European Military End-use Equipment Sector, by Product Type, 2005-2010

- European Military Connector 2015 Forecast with 5-Year CAGR

- European Military Connector Market, by Country 2015 Forecast and Five-Year CAGR

- European Military Connector 2015 Forecast by Product Type

- European Military Connector Market by Product Type 2015 Forecast and Five-Year CAGR

Chapter 6 - Other Military Market Segments

- Japan

- Brazil, Russia, India, and China (BRIC)

- Brazil

- Russia

- India

- China

- Asia-Pacific

- Australia

- Indonesia

- Malaysia

- South Korea

- Taiwan

- Thailand

- Vietnam

- Rest of World (ROW)

Chapter 7 - Military Connector Market

- Major Influences on the Military Connector Market

- Connector Opportunities in the Military Market

- Connector Trends in the Military Market

- Connector Product Types in Military Market Applications

- Military Connector Product Characteristics (typical)

- Environmental Protection Mandates

Chapter 8 - Military Avionics Market

- Military Avionics Market

- Market Conditions

- Worldwide Active Fleet Share by Role and Region

- Market Drivers

- Market Challenges

- Key Players

- Global Players – Top 20 Military Aircraft Avionics

- Companies

- United States

- Europe

- Middle East

- Japan

- China/Russia/Asia-Pacific

- India

- Pakistan

- ROW

- Applications/Equipment Types

- Worldwide Active Fleet by Role

- Combat Aircraft

- Major Combat Aircraft

- Reconnaissance/Surveillance Aircraft

- Transport/Tankers

- Military Helicopter Market

- Market Conditions

- Key Military Helicopter Submarkets

- Market Drivers

- Market Challenges

- Key Players

- Leading Military Helicopter Companies

- Technology

- Significant Military Helicopter Programs

- Significant Military Helicopter Programs (by Country)

- Applications/Equipment Types

- Connector Use in Military Avionics

- Upgrades vs. Retrofit

- Technology

- Military Aircraft Avionics Systems

- Fighter Radar Technology

- Current Production Fighter Radars for Western Built

- Aircraft Types (2010)

- U.S. Air Force (USAF) FY2012

- U.S. Air Force FY2012 Budget Summary

- Procurement

- U.S. Air Force Procurement Summary

- U.S. Air Force Procurement TOA

- Procurement – Aircraft

- U.S. Air Force Aircraft Procurement TOA

- U.S. Air Force Aircraft Procurement - Quantity

- Procurement – Missile

- U.S. Air Force Missile Procurement TOA

- U.S. Air Force Missile Procurement - Quantity

- Procurement – Ammunition

- Procurement – Other

- Air Superiority

- Space Superiority

- Intelligence, Surveillance and Reconnaissance (ISR)

- Command and Control

- Research, Development, Test & Evaluation

Chapter 9 - Missile Systems Market

- Types of Missiles

- Active U.S. Military Missiles

- Market Drivers

- Market Challenges

- Key Global Players

- Global Players - Missile Systems Market

- Missile Defense

- U.S. Missile Defense Agency (MDA) – Joint Service

- Canceled:Medium Extended Air Defense System (MEADS)

- The Ballistic Missile Defense System (BMDS)

- AEGIS Ballistic Missile Defense (BMD)

- Command, Control, Battle Management, and Communications (C2BMC)

- Ground-based Midcourse Defense (GMD)

- BMDS Sensors

- Terminal High Altitude Area Defense (THAAD)

- PATRIOT Advanced Capability-3 (PAC-3)

- Missile Defense Systems — International Cooperation

- Missile and Munitions

- Conventional Guided Missiles

- Laser-Guided Missile

- Technology

- Precision-Guided Munitions

- Missile Types and Missile Platforms

- Air-to-Air Missiles

- Air-to-Surface Missiles (Also Known as Air-to-Ground)

- Surface-to-Surface

- Surface-to-Air Missiles

- Cruise Missiles

- Ballistic Missiles

- Anti-Submarine Warfare (ASW)

- Mine Warfare

Chapter 10 - Space Systems Market

- Market Conditions

- Market Drivers

- Space Infrastructure

- U.S. DoD Space Activity

- Technology

- Applications

- Efficient Satellite Services

- New Ka-band Satellite Constellation

- OCX: the Future GPS Operational Ground Control Segment

- Joint Polar Satellite System (JPSS)

- Connector Use in Space

- U.S. NASA FY2012 Proposed Budget

- Space-Based Systems

Chapter 11 - Land Forces

- Armored Ground Vehicles Market

- Market Conditions

- Market Drivers

- Market Challenges

- Global Players – Armored Vehicle Market

- Leading National Armored Vehicles Markets (including Upgrade and Retrofit)

- Technology

- Electronic Applications/Systems

- Types of Armored Vehicles

- Armored Fighting Vehicle

- Tracked Vehicles – Main Battle Tanks

- Tracked Vehicles (Not Tanks)

- Combat Vehicles

- Family of Heavy Tactical Vehicles (Heavy Equipment Transporters)

- Family of Medium Tactical Vehicles (including Combat)

- Medium Mine-Resistant Vehicles

- Light Protected Vehicles

- U.S. Army

- U.S. Army FY2012 Budget Request

- Department of the Army: TOA

- FY2012 US Army Procurement Summary

- U.S. Army Procurement Summary

- Program Updates

- U.S. Army Supply Chain

- U.S. Army Aircraft Programs

- U.S. Army Aircraft Procurement Summary

- US Army Missile Programs

- U.S. Army Missiles Procurement Summary

- Weapons and Tracked Combat Vehicles

- U.S. Army Weapons and Tracked Combat Vehicles

- Procurement Summary

- Tracked Combat Vehicles: Major Programs

- Weapons and Army Support Arms

- Ammunition Procurement

- U.S. Army Ammunition Procurement Summary

- Other Procurement Program Funds

- U.S. Army Other Procurement Summary Tactical/Support Vehicles

- Communications

- U.S. Army Other Procurement Summary

- Communications and Electronics

- Research, Development, Test & Evaluation Program Funds

- Connector Use in the Army

- Soldier Systems

- The Soldier Modernization Market

- Modular Soldier Systems

- Soldier Systems – SWaP (Size, Weight and Power)

- Sensors

- Portable Video Net Systems

- Night Vision

- Thermal Weapon Sights (TWS)

Chapter 12 - Command, Control, Communications, Computer and Intelligence (C4I) Systems

- C4I Systems

- Warfighter Information Network-Tactical (WIN-T)

- Satellite Communications

- Communication Networks

- Joint Tactical Radio System (JTRS)

- Communication Data Links

- Net-Centric Warfare (NCW) Technology Needs

- Advanced Telecommunications Computing Architecture (ATCA)

- Multifunction I/O Boards

- Antennas

- Commercial Hand-held Devices

Chapter 14 - Unmanned Vehicles

- Market Conditions

- Market Drivers

- Key Players in Unmanned Vehicle Systems Market

- Technology

- Applications/Equipment Types

- Unmanned Vehicles – Robots

- Autonomous robots

- Unmanned Ground Vehicles (UGV)

- Unmanned Underwater Vehicles (UUV)

- Micro and Small UAV

- Medium UAV

- Large UAV

- Ground Control Stations and Unmanned Vehicle Systems

Chapter 15 - Military Market Supply Chain

- Market Conditions/Drivers

- Acquisition reform: A Focus on Upgrades

- U.S. DoD Procurement

- Will-Cost/Should-Cost Program

- Pending U.S. Supply Chain Regulations

- Ruggedized COTS Systems

- Counterfeit Electronic Components

- EU Defense Procurement Directive

- Offset Agreements

- Top 100 U.S. Defense Companies for 2010

- Top 100 U.S. Defense Companies (based on 2010 fiscal year) by Defense Contract $ Value

- Top 100 Global Defense Contractors for 2010

- Top 100 Global Defense Contractors for 2010 by Base of Operations and Defense Revenue

- Military Connector Manufacturers

- Top 10 Connector Suppliers to the Military Market

- (Ranked by Total Military Connector Sales)

- Top 10 Connector Suppliers to the Military Market 2010

- (Percent of Total World Military Connector Sales)

- Manufacturers, 2010 Total Connector Sales and the Percent of Total Sales

- Top 26 Connector Manufacturers to the Military Market (2010)

- Ranked by Military Connector Sales

- Top Connector Suppliers to the Military Industry

- 2010 Global Top 100 Connector Manufacturers to the Military Market

- Global Top 100 Connector Manufacturers Segmented by Rank (2010)

Chapter 16 - Military Connector Market - Statistical Overview

- Connector Statistics for the Military Market 2009 and 2010

- World 2009 and 2010 Military Connector Sales by Region

- World 2009 and 2010 Military Connector Sales by Region with Percent Change

- 2010 World Military Connector Sales by Regional Share

- Connector Statistics for the Military Market 2010 and 2011F

- World 2010 and 2011F Military Connector Sales by Region

- World 2010 and 2011F Military Connector Sales by Region with Percent Change

- World Military Market for Connectors by Connector Family, 2009, 2010, and 2011F

- World 2009, 2010, and 2011F Military Sales by Connector Family with Percent Change

- World 2009 and 2010 Military Sales by Connector Family with Percent Change

- World 2010 and 2011F Military Sales by Connector Family with Percent Change

- 2009 Military Sales by Region and Connector Family

- 2010 Military Sales by Region and Connector Family

- 2011F Military Sales by Region and Connector Family

- North American 2009, 2010, and 2011F Military Sales by Connector Family with Percent Change

- Europe 2009, 2010, and 2011F Military Sales by Connector Family with Percent Change

- Japan 2009, 2010, and 2011F Military Sales by Connector Family with Percent Change

- China 2009, 2010, and 2011F Military Sales by Connector Family with Percent Change

- Asia-Pacific 2009, 2010, and 2011F Military Sales by Connector Family with Percent Change

- ROW 2009, 2010, and 2011F Military Sales by Connector Family with Percent Change

- Connector Statistics for the Military Connector Market 2010-2015

- World 2010 and 2015 Military Connector Sales by Region

- 2015 World Military Connector Sales by Regional Share

- World 2010 and 2015 Military Connector Sales by Region

- World 2010 and 2015 Military Connector Sales by Region with 5-Year CAGR

- World Military Market for Connectors by Connector Family, 2010-2015

- World 2010 and 2015 Military Sales by Connector Family

- World 2010 and 2015 Military Connector Sales by Connector Family and 5-Year CAGR

- 2015 Military Sales by Region and Connector Family

- North America 2010 and 2015 Military Sales by Connector Family

- North America 2010 and 2015 Military Connector Sales by Connector Family and 5-Year CAGR

- Europe 2010 and 2015 Military Sales by Connector Family

- Europe 2010 and 2015 Military Connector Sales by Connector Family and 5-Year CAGR

- Japan 2010 and 2015 Military Sales by Connector Family

- Japan 2010 and 2015 Military Connector Sales by Connector Family and 5-Year CAGR

- China 2010 and 2015 Military Sales by Connector Family

- China 2010 and 2015 Military Connector Sales by Connector Family and 5-Year CAGR

- Asia-Pacific 2010 and 2015 Military Sales by Connector Family with 5-Year

- Asia-Pacific 2010 and 2015 Military Connector Sales by Connector Family and 5-Year CAGR

- ROW 2010 and 2015 Military Sales by Connector Family

- ROW 2010 and 2015 Military Connector Sales by Connector Family and 5-Year CAGR

This is invisible

Introduction

This report provides a quantitative analysis of the World Military Connector Market. This 16 chapter, 315-page research report identifies current major military programs and future applications with high growth potential, and provides a breakdown of the market value for connectors by region, by type, and wherever possible, by application.

Connector sales and forecasts are presented for the years 2009, 2010, and 2015.

Market segments include:

- Military Avionics

- Missile Systems

- Space Systems

- Land Forces

- C4I Systems

- Naval Vessels

- Unmanned Vehicles

The military and aerospace industry is a valuable economic asset and a major source of employment, exports, and technology advancement. As with most industries, it requires competition and investment remain vital and advance. Unlike other industries, defense business depends critically on governments in their role as regulators, customers, and investors. On average, over the last five years, governments worldwide have consistently spent 2.7% of their global gross domestic product on military expenditures.

North America, which represented 47.1% of all connector sales in the military/aerospace sector in 2010, is by far the driving factor behind connector sales in this sector. North America has consistently had the greatest sales of connectors used in the military sector and had the second-largest year-to-year growth. China ranked last in connector sales to the military sector, and exhibited the greatest growth.

There will be reduced global spending on new platforms in North America and Europe as troops continue to withdraw from Afghanistan and Iraq. However, there will be increased spending on upgrades and retrofit programs. Although all regions are anticipated to show positive growth, sales in North America, Europe, and Japan will be modest, while sales in China will increase significantly. The Asia-Pacific and ROW region, which includes Central America, South America, South Africa, and Russia, is also anticipated to have above average growth.

World 2010 and 2015 Military Connector Sales by Region

Above-average growth will be seen in the Fiber Optic family. Three areas of growth, beyond the traditional Circular and PCB connectors, will be seen in the Application Specific, Heavy Duty, and the RF Coax family. The increase in sales in these families will be attributed to an increase in portable power requirements and the continued advancement of network centric operations/warfare, where every vehicle, ship, plane, weapon, and soldier becomes a node on huge strategic information network.

Download a descriptive brochure here