Instrumentation Market for Connectors

| Report Number: M-310-21 |

Price:

$5135.00

|

| Publication Date: June 2021 |

This is invisible

Instrumentation Market for Connectors

Instrumentation equipment companies are expanding their technical capabilities, products, and software platforms to meet the need for higher speeds and extremely higher frequencies (EHF) to participate in the next decade of significant growth. This creates opportunity for connector suppliers.

Today, connector companies that are either already in, or are aspiring to enter the instrumentation market, may be contemplating their business strategies, and asking themselves:

- What is the size and expected growth of the instrumentation equipment market, and its most relevant sub-sectors?

- What is the size and expected growth of the instrumentation connector market?

- What are the market and technology factors enabling this growth?

- Who are the top 15 instrumentation equipment manufacturers and what do they offer?

- Who are the top 30 instrumentation connector suppliers and what connectors do they offer?

Bishop & Associates, latest research report, Instrumentation Market for Connectors provides in-depth analysis of the markets, products, and technologies of instrumentation equipment makers and provides examples of connectors used in instrumentation applications by sub-sector. Tables are included detailing total connector sales, instrumentation connector sales by sub-sector, region, and product type, as well as a five-year forecast.

This is invisible

Instrumentation Market for Connectors

Chapter 1 – Objective, Scope, and Report Creation Methodology

- Objective

- Scope

- Report Creation Methodology

- Market Segment Definitions

- Regional Market Definitions

- Other Terms and Definitions

Chapter 2 – Executive Summary

- Global Instrumentation Connector Sales Executive Summary

- Automatic Test Equipment Market Summary

- Analytical & Scientific Equipment Market Summary

- Other Instrumentation Equipment Market Summary

- Regional Instrumentation Connector Market Conditions

- North America

- Europe

- Japan

- China

- Asia Pacific

- ROW

- Primary Instrumentation Market Trends

- Primary Instrumentation Technology Trends

- Primary Instrumentation Connector Trends

- Market Impacts Influencing Instrumentation Connector Prices

- Other Influences Impacting Instrumentation Connector Sales

- Test, Measurement, and Instrumentation – Engineering Expert Survey Opinions

- Merger & Acquisition Investment Highlights, Over the Past 10 Year (pre-pandemic)

- Pre-Pandemic – M&A, Investment Highlights, Over the Past 10 Years

- Merger & Acquisition Investment Highlights, Over the Past 18 Months (during pandemic)

- Recent – M&A Investment Highlights Over the Last 18 Months

- Test, Measurement, and Instrumentation – Subject Matter Expert Opinions

- Summary of Top 10 Anticipated Future Investments by Major Players

- Transformative 6G Technology (beyond 5G) is not that far off

- The Difference Between 5G and 6G

Chapter 3 – Worldwide Instrumentation Connector Sales Analysis

- Worldwide Instrumentation Connector Sales Analysis

- Total Worldwide Connector Market by Industry 2026F

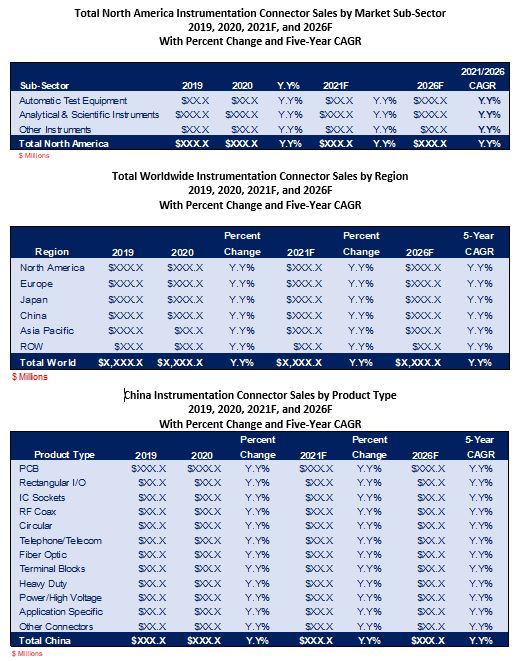

- Total Worldwide Instrumentation Connector Sales by Region 2019, 2020, 2021F, and 2026F With Percent Change and Five-Year CAGR

- Total Worldwide Instrumentation Connector Sales by Region 2019 through 2026F

- Total Worldwide Instrumentation Connector Sales by Region 2021F

- Total Worldwide Instrumentation Connector Sales by Region 2026F

- Total Worldwide Instrumentation Connector Sales by Region 2021F versus 2026F

- Total Worldwide Instrumentation Connector Sales by Market

- Sub-Sector 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAGR

- Total Worldwide Instrumentation Connector Sales by Market Sub-Sector 2021F versus 2026F

- North America Instrumentation Connector Sales by Market Sub-Sector 2019 through 2026F with Percent Change and Five-Year CAGR

- North American Instrumentation Connector Sales by Market Sub-Sector 2021F versus 2026F

- European Instrumentation Connector Sales by Market Sub-Sector 2019 through 2026F with Percent Change and Five-Year CAGR

- European Instrumentation Connector Sales by Market Sub-Sector 2021F versus 2026F

- Japan Instrumentation Connector Sales by Market Sub-Sector 2019 through 2026F with Percent Change and Five-Year CAGR

- Japan Instrumentation Connector Sales by Market Sub-Sector 2021F versus 2026F

- China America Instrumentation Connector Sales by Market Sub-Sector 2019 through 2026F with Percent Change and Five-Year CAGR

- China Instrumentation Connector Sales by Market Sub-Sector 2021F versus 2026F

- Asia Pacific Instrumentation Connector Sales by Market Sub-Sector 2019 through 2026F with Percent Change and Five-Year CAGR

- Asia Pacific Instrumentation Connector Sales by Market Sub-Sector 2021F versus 2026F

- ROW Instrumentation Connector Sales by Market Sub-Sector 2019 through 2026F with Percent Change and Five-Year CAGR

- ROW Instrumentation Connector Sales by Market Sub-Sector 2021F versus 2026F

- Total Worldwide Instrumentation Connector Sales by Product Type 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAGR

- Total Worldwide Instrumentation Connector Sales by Product Type 2021F

- North America Instrumentation Connector Sales by Product Type 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAGR

- North America Instrumentation Connector Sales by Product Type 2021F

- European Instrumentation Connector Sales by Product Type 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAGR

- European Instrumentation Connector Sales by Product Type 2021F

- Japan Instrumentation Connector Sales by Product Type 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAGR

- Japan Instrumentation Connector Sales by Product Type 2021F

- China Instrumentation Connector Sales by Product Type 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAG

- China Instrumentation Connector Sales by Product Type 2021F

- Asia Pacific Instrumentation Connector Sales by Product Type

- 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAGR

- Asia Pacific Instrumentation Connector Sales by Product Type 2021F

- ROW Instrumentation Connector Sales by Product Type 2019, 2020, 2021F, and 2026F with Percent Change and Five-Year CAGR

- ROW Instrumentation Connector Sales by Product Type 2021F

Chapter 4 – Automatic Test Equipment (ATE) Market

- Automatic Test Equipment Market Analysis

- ATE Market Growth

- ATE Connector Market Growth

- Industries Fueling Growth of ATE Market

- Semiconductor ATE Market

- Market Growth

- Market and Technology Factors

- Key Players

- System-on-Chip

- System Level Test (SLT)

- Semiconductor Testing Connector Selection

- Advanced Microelectronics Package Design

- In-Circuit (In-Line) Test Handling Equipment

- In-Line Automated inspection Equipment

- In-Circuit Testing Market Growth

- Market and Technology Factors

- Key Players

Chapter 5 – Analytical & Scientific Instrumentation Market

- Analytical & Scientific Instrument Market Analysis

- Analytical & Scientific Instruments Market Growth

- Analytical & Scientific Instruments Connector Market Growth

- Industries Fueling Growth of Analytical & Scientific Instruments

- Market and Technology Factors

- Key Players

- Fiber Optical Test Equipment Market

- Primary Fiber Optical Test Equipment Types

- Fiber Optical Test Equipment Market Growth

- Fiber Optical Market and Technology Factors

- Key Players

- Optical Time Domain Reflectometer (OTDR) and Optical Multimeter (OM) Test Equipment

- Passive Optical Network (PON) and Optical Power Meters (OPM) Testers

- Dense Wavelength Division Multiplexing (DWDM) Pluggable Equipment

- RF Test Equipment Market

- RF Test Equipment Market Size and Growth Rate

- RF Test Equipment Market and Technology Factors

- Key Players

- Vector Network Analyzers (VNAs)

- RF Millimeter Wave (mmWave) Test Equipment Market

- mmWave Technology Market Size and Growth

- Key Players

- mmWave Market and Technology Factors

- Passive Intermodulation (PIM) Test Equipment

- Geotechnical Instrumentation Market

- Pile-Echo Test (PET) or Pulse-Echo Test Equipment

- Peripheral Component Interconnect Express (PCI Express, abbreviated as PCIe) Testing.

- USB Technology Continues to Evolve

Chapter 6 – Other Instrumentation Equipment Market

- Other Instrumentation Equipment Market Analysis

- Other Instrumentation Equipment Market Growth

- Other Instrumentation Connector Market Growth

- Oscilloscopes

- Oscilloscope Market Growth

- Oscilloscope Market and Technology Factors

- Oscilloscope Probes

- Oscilloscope Probe Market Growth

- Multimeters

- Multimeter Market Growth

- Multimeter Market and Technology Factors

- Electrical Calibration Equipment

- Electrical Calibration Equipment Market Growth

- Electrical Calibration Equipment Market and Technology Factors

Chapter 7 – Test & Measurement Equipment Company Profiles

- Top15 – Test, Measurement, and Instrumentation Companies

- FY2020 Sales for the Top 15 Test, Measurement, and Instrumentation Companies

- Primary Markets Served by the Top 15 Test, Measurement, and Instrumentation Companies

- Worldwide Instrumentation Equipment Market Size and Growth Rate 2020 and 2026F

- Fortive

- Fluke

- Tektronix

- Yokogawa

- Keysight Technologies

- Teradyne

- Rohde & Schwarz

- Teledyne Technologies

- Agilent Technologies

- FLIR Systems

- Advantest

- National Instruments

- Spectris plc

- VIAVI Solutions

- Anritsu

- Spirent Communications plc

- EXFO

Chapter 8 – Top 30 Instrumentation Connector Companies

- Top 30 Instrumentation Connector Companies – 2019 Shipments

- 2019 Average Sales and Market Share per Worldwide Instrumentation Rank Grouping

- Top 30 Instrumentation Connector Companies – 2019 Shipments

- Top 10 instrumentation Connector Companies – 2019 Shipments

- Top 11-20 Instrumentation Connector Companies – 2019 Shipments

- Top 21-30 Instrumentation Connector Companies – 2019 Shipments

This is invisible

Bishop & Associates Inc. has just released their newest report, Instrumentation Market for Connectors. This eight-chapter, 223‐page research report provides detailed information on the instrumentation market, including connector types used and their suppliers, instrumentation equipment suppliers, and applications where connectors are found in the instrumentation market.

The total worldwide value of connector shipments to the Test, Measurement, and Instrumentation (TMI) market in 2020 was $X,XXX.7 million, representing a decrease of Y.Y% over the prior year. Although 2020 results vary regionally, the worldwide TMI industry was negatively affected by market conditions resulting from the COVID-19 pandemic. Longer lead-time and higher cost items, especially for ATE systems, involving capital budgets had more stability than analytical & scientific instrumentation that are often project focused with reactive short-term budget affects. However, that trend is expected to reverse itself in 2021 and beyond.

The outlook for the value of connector shipments for the worldwide TMI market in 2021 is projected at $X,XXX.2 million, an increase of Y.Y% over the previous year, reflecting the recovery starting late 2020. By 2026, total worldwide Instrumentation connector sales are expected to reach $X,XXX.0 million, representing a five-year CAGR of Y.Y%.

The global instrumentation market is broken down into three primary categories Automatic Test Equipment (ATE), Analytical & Scientific Instruments, and Other Instruments. The global Automated Test Equipment market is expected to exceed $X.23 billion by 2026 with a five-year CAGR of Y.64% over the period. Automated test equipment for semiconductor testing, in-circuit (or test handler) testing, and other automated testing systems for electronics, telecommunications, automotive and transportation, industrial, aerospace and defense, medical and other growing industries are expected to drive market growth over the forecast period.

The global Analytical & Scientific Instruments market is expected to exceed $XX.02 billion by 2026 with a five-year CAGR of Y.38% over the period, primarily resulting from growth in medical, life sciences, biopharma and all its related clinical research laboratory instrument testing, telecommunications, consumer electronics, and other industries benefiting from 5G technology.

The total worldwide value of connector shipments to the Other Instruments segment in 2020 was $XXX.8 million, a small decrease of Y.Y% from 2019. The forecast value of connector shipments for 2021 is estimated to reach $XXX.4 million, reflecting a Y.Y% increase from the prior year, which was impacted by the COVID-19 pandemic. By 2026, the worldwide Instrumentation connector forecast for Other Instruments is expected to reach $XXX.3 million, representing a five-year CAGR of Y.5%.

As shown on the following pages, tables included in the report provide sales by region for connectors used in instrumentation applications, sales by connector product types by region used in instrumentation applications and instrumentation connectors sales by region.

Download a descriptive brochure here