Medical Electronics Market for Interconnect Solutions

| Report Number: M-1501-20 |

Price:

$5525.00

|

| Publication Date: July 2020 |

This is invisible

Medical Electronics Market for Interconnect Solutions

This is an equipment sector that places high value on technology, quality, innovation, and material expertise. The medical market for connectors offers major opportunities for both connector industry leaders and the niche manufacturer.

- What trends are driving growth in the medical equipment sector? What role will demographics play in this growth and how will it affect product design and marketing? How has Covid-19 affected the types of equipment being manufactured today? What role will technologies like robotics, 5G Ethernet, mobile health (mHealth), or artificial intelligence play in the growth of the medical equipment sector?

- Who are the major connector suppliers to the medical equipment sector and what types of connector products are they supplying? Who are the major medical equipment manufacturers? What role do government regulations play in the design, marketing, and sale of medical equipment? How do regulations affect export and import demands?

- How important are design features such as low insertion force, non-magnetic materials, polarization and sterilization capabilities, and the ability to handle a variety of contact types, including power, coax, signal, fiber, air, and fluid?

Bishop & Associates newest research report, Medical Electronics Market for Interconnect Solutions analyzes the many aspects involved in the design, development, approval, and marketing of connectors used in the medical market. Tables are included detailing medical connector market sales by region, by medical equipment sub-sector, and by connector product type for the years 2017 through 2025, including a five-year CAGR. A market sector where failure can literally be the difference between life and death, the medical market for connectors may offer designers and manufactures numerous challenges, but the rewards will generally outweigh the challenges.

This is invisible

Medical Electronics Market for Interconnect Solutions

Chapter 1 – Objective, Scope, and Methodology

- Objective

- Scope

- Report Creation Methodology

- Market Segments

- Diagnostic Imaging & Patient Monitoring Equipment

- Therapeutic Equipment

- Other Medical Equipment

- Exclusions

- Definitions

- Regional Market Definitions

Chapter 2 – Executive Summary

- Medical Market Conditions

- Medical Market and Technology Trends

- Imaging

- Patient Monitoring

- Surgical Equipment

- Therapeutic Equipment

- Interventional Equipment

- Consumer Equipment

- Medical Connector Market Outlook

Chapter 3 – Political, Economic, Sociocultural, Technological, Environmental, and Legal Analysis

- Pestel Analysis

- Political Factors

- The Affordable Care Act

- Medical Device/Export/Import Imbalance

- Ireland Tax Benefits to MedTech Companies

- Tariff War with China

- Medical Devices Excluded from Chinese Tariffs Include

- USMCA Replaces NFTA

- Economic Factors

- Sociocultural Factors

- Determinants of Health

- Technological Factors

- Wearable Device Technologies and the Internet of Things (IoT)

- Connected Health Devices

- 3D Printing Technology

- 5G and Artificial Intelligence (AI)

- Sensor Technology

- Automation and Scalability

- Additional Medical Device Markets influenced by Innovative Technologies

- Digital Connectivity Technology Influencers and Enablers

- Environmental Factors

- Corporate Social Responsibility

- Reusable Medical Products

- Disposable, “Single-Patient-Use” Medical Products

- Electronics and Chemicals used in Medical Products

- WEEE Compliance

- RoHS is a Worldwide Initiative

- Legal Factors

- Global Medical Market Demographics

- Worldwide Population by Country

- World Population Clock

- Worldwide Ageing Population Trend

- Life Expectancy Chart

- Worldwide Healthcare Spend as Percent of GDP

- Medical Market Attractiveness

- Medical Market Challenges

- The Regulatory Environment

- Common Government Regulation – General Process Framework

- United States

- European Union

- CE Marking

- Japan

- Australia

- Canada

- Brazil

- Russia

- India

- China

- International Electromechanical Commission (IEC)

- Association for the Advancement of Medical Instrumentation (AAMI)

Chapter 4 – Global Medical Interconnect Solution Sales Analysis

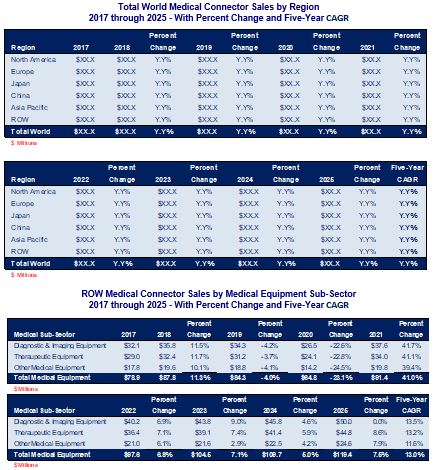

- Global Medical Connector Sales by Region 2017 through 2025F with Percent Change and Five-Year CAGR

- Global Medical Connector Sales by Region 2020F versus 2025F

- Global Medical Connector Sales by Region 2019 through 2025F

- Total World Medical Connector Market Share by Region 2020F

- Total World Medical Connector Market Share by Region 2025F

- Global Medical Connector Sales for the Diagnostic & Imaging Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- Global Medical Connector Sales for the Therapeutic Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- Global Medical Connector Sales for the Other Medical Equipment 2017 through 2025F with Percent Change and Five-Year CAGR

- North American Medical Connector Sales by Medical Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- North American Medical Connector Sales by Medical Equipment Sub-Sector 2020F versus 2025F

- European Medical Connector Sales by Medical Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- European Medical Connector Sales by Medical Equipment Sub-Sector 2020F versus 2025F

- Japanese Medical Connector Sales by Medical Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- Japanese Medical Connector Sales by Medical Equipment Sub-Sector 2020F versus 2025F

- Chinese Medical Connector Sales by Medical Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- Chinese Medical Connector Sales by Medical Equipment Sub-Sector 2020F versus 2025F

- Asia Pacific Medical Connector Sales by Medical Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- Asia Pacific Medical Connector Sales by Medical Equipment Sub-Sector 2020F versus 2025F

- ROW Medical Connector Sales by Medical Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- ROW Medical Connector Sales by Medical Equipment Sub-Sector 2020F versus 2025F

- Total World Medical Connector Sales by Medical Equipment Sub-Sector 2017 through 2025F with Percent Change and Five-Year CAGR

- Total World Medical Connector Sales by Medical Equipment Sub-Sector 2020F versus 2025F

- North American Medical Connector Sales by Product Type 2017 through 2025F with Percent Change and Five-Year CAGR

- North American Medical Connector Sales 2019 through 2025F

- North American Medical Connector Sales by Product Type 2020F versus 2025F

- European Medical Connector Sales by Product Type 2017 through 2025F with Percent Change and Five-Year CAGR

- European Medical Connector Sales 2019 through 2025F

- European Medical Connector Sales by Product Type 2020F versus 2025F

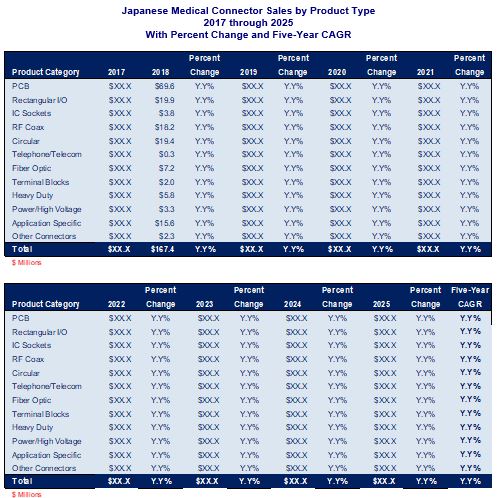

- Japanese Medical Connector Sales by Product Type 2017 through 2025F with Percent Change and Five-Year CAGR

- Japanese Medical Connector Sales 2019 through 2025F

- Japanese Medical Connector Sales by Product Type 2020F versus 2025F

- Chinese Medical Connector Sales by Product Type 2017 through 2025F with Percent Change and Five-Year CAGR

- Chinese Medical Connector Sales 2019 through 2025F

- Chinese Medical Connector Sales by Product Type 2020F versus 2025F

- Asia Pacific Medical Connector Sales by Product Type 2017 through 2025F with Percent Change and Five-Year CAGR

- Asia Pacific Medical Connector Sales 2019 through 2025F

- Asia Pacific Medical Connector Sales by Product Type 2020F versus 2025F

- ROW Medical Connector Sales by Product Type 2017 through 2025F with Percent Change and Five-Year CAGR

- ROW Medical Connector Sales 2019 through 2025F

- ROW Medical Connector Sales by Product Type 2020F versus 2025F

- Total World Medical Connector Sales by Product Type 2017 through 2025F with Percent Change and Five-Year CAGR

- Total World Medical Connector Sales 2019 through 2025F

- Total World Medical Connector Sales by Product Type 2020F versus 2025F

Chapter 5 – Diagnostic Market Analysis

- Diagnostic Imaging Market Analysis

- Diagnostic Ultrasound Imaging

- Market Factors

- Market Expansion

- Technology Factors

- Key Players

- Ultrasound Image Quality and Clarity Evolves

- The Evolutions of Portable Ultrasound Devices

- Ultrasound Transducer Technology Evolves

- Ultrasound Transducer Technology

- Ultrasound Connector Technology

- Magnetic Resonance and Computed Tomography Equipment

- Market Factors

- Technology Factors

- Key Players

- Computerized Tomography Imaging Equipment

- Computed Tomography Imaging Equipment

- Market Factors

- Technology Factors

- Key Players

- X-Ray and Digital X-Ray Imaging Equipment

- Market Factors

- Technology Factors

- Key Players

- Digital X-Ray for Intraoral Dental Applications

- Veterinary Portable Digital X-Ray Applications

Chapter 6 – Patient Monitoring Market Analysis

- Vital Signs Equipment Market

- Electrocardiograph (ECG)

- Market Factors

- Technology Factors

- Key Players

- Disposable, Single-Patient-Use ECG Cables and Lead Wires

- Blood Pressure Monitoring Market

- Market Factors

- Technology Factors

- Key Players

- Non-Invasive Blood Pressure (NIBP) Monitoring

- Continuous Non-Invasive Blood Pressure (cNIBP)

- Invasive Blood Pressure (IBP) Monitoring

- Diagnostic ECG Equipment Market

- Market Factors

- Technology Factors

- Key Players

- Diagnostic Resting ECG for Clinical Workflow

- Stress Testing ECG

- Holter ECG

- Pocket ECG

- Pulse Oximetry (SpO2) Market

- Market Factors

- Technological Factors

- Key Players

- Brain Monitoring Equipment Market

- Market Factors

- Technology Factors

- Key Players

- ECG Sleep Disorders

- EEG Leads

Chapter 7 – Therapeutic Equipment Market Analysis

- Electrophysiology

- Market Factors

- Technology Factors

- Key Players

- External Defibrillation Equipment

- Market Factors

- Technology Factors

- Key Players

- Public Sector and Home Health Automated External Defibrillators

- Wearable External Defibrillator

- Implantable Cardioverter Defibrillator (ICD) and Pacemaker Equipment

- Market Factors

- Technology Factors

- Key Players

- Respiratory Therapeutic Equipment

- Market Factors

- Technology Factors

- Key Players

- Additional Players

- New Entrants

- New Ventilator Entrants – US Market Leading Automakers

- Ventilator Connector Content

- Continuous Positive Airway Pressure (CPAP) Equipment

- Market Factors

- Technology Factors

- Nebulizers

- Humidifiers

Chapter 8 – Surgical Equipment Market Analysis

- Endoscopy Equipment Market

- Market Factors

- Technology Factors

- Key Players

- Surgical Robotic and Computer-Assisted Surgery Equipment Market

- Market Factors

- Technology Factors

- Key Players

- Dental Equipment Market

- Market Factors

- Technology Factors

- Key Players

- Electrosurgical Equipment Market

- Market Factors

- Technology Factors

- Key Players

- Surgical Laser Equipment Market

- Market Factors

- Technology Factors

- Key Players

Chapter 9 – Other Medical Equipment Market Analysis

- Audiology (Hearing Aid) Equipment Market

- Market Factors

- Technology Factors

- Key Players

- Patient Mobility Systems Market

- Market Factors

- Technology Factors

- Diabetes Care Equipment Market

- Market Factors

- Technology Factors

- Key Players

- Temperature Monitoring

- Market Factors

- Technology Factors

- Key Players

Chapter 10 – Medical Product Design and Manufacturing Considerations, Sourcing Trends, and Supply Chain Analysis

- Product Requirements Document (PRD)

- Marketing Requirements Document (MRD)

- Validation and Verification (V&V)

- Application

- Environmental

- Design

- Standard, Iteration, or Custom

- Materials

- Connector Mating System

- Electrical

- Mechanical

- Safety and Efficacy

- Regulatory Requirements

- Industry Standards

- Lead-time

- Cost

- Inside-the-Box Connectors

- Medical Product Manufacturing Considerations

- Medical Manufacturing Mindset

- Patience

- Proximity

- Site Visits

- Manufacturing Location

- ISO 13485 Medical Certification

- Clean Room Manufacturing

- Medical Product Outsourcing Trends

- Medical Product Outsourcing Trends Impacting Connector and Cable Decision

- Medical Product Outsourcing Trends

- Medical Connector Technology Trends Provide Positive Market Impacts

- Connector Supply Chain Analysis

- ODM Market Dynamics

- Medical Connector and Cable Assembly Cost Drivers

- Medical Connector and Cable Assembly – Cost Model A

- Medical Connector and Cable Assembly – Cost Model B

- Medical Connector and Cable Assembly – Cost Model C

- Switching Cost Considerations

- Switching Cost Models

- Some Factors Impacting Gross Margins

- Outside-the-Box Medical Connectors and Cable Assemblies

- Inside-the-Box Medical Connectors and Cable Assemblies

- Important Criteria for Decision Makers

- Importance of Being on the “Approved Vendor List”

Chapter 11 – Medical Interconnect Solutions Companies

- The Top 10 Worldwide Medical Connector Suppliers - Sales

- Global Top 10 Medical Connector Suppliers - 2018 Medical Connector Sales & Market Share

- Molex

- Molex – Connector Sales by Market Segment

- Molex Worldwide Rank, Sales, and Market Share by Market Segment

- Molex – Connector Sales by Product

- Molex Worldwide Rank, Sales, and Market Share by Product Type

- TE Connectivity

- TE Connectivity – Connector Sales by Market Segment

- TE Connectivity Worldwide Rank, Sales, and Market Share by Market Segment

- TE Connectivity – Connector Sales by Product Type

- TE Connectivity Worldwide Rank, Sales, and Market Share by Product Type

- Amphenol

- Amphenol – Connector Sales by Market Segment

- Amphenol Worldwide Rank, Sales, and Market Share by Market Segment

- Amphenol – Connector Sales by Product Type

- Amphenol Worldwide Rank, Sales, and Market Share by Product Type

- Luxshare

- Luxshare – Connector Sales by Market Segment

- Luxshare Worldwide Rank, Sales, and Market Share by Market Segment

- Luxshare – Connector Sales by Product Type

- Luxshare Worldwide Rank, Sales, and Market Share by Product Type

- LEMO

- LEMO – Connector Sales by Market Segment

- LEMO Worldwide Rank, Sales, and Market Share by Market Segment

- LEMO – Connector Sales by Product Type

- LEMO Worldwide Rank, Sales, and Market Share by Product Type

- Samtec

- Samtec – Connector Sales by Market Segment

- Samtec Worldwide Rank, Sales, and Market Share by Market Segment

- Samtec – Connector Sales by Product Type

- Samtec Worldwide Rank, Sales, and Market Share by Product Type

- ept GmbH

- ept GmbH – Connector Sales by Market Segment

- ept GmbH Worldwide Rank, Sales, and Market Share by Market Segment

- ept GmbH – Connector Sales by Product Type

- ept GmbH Worldwide Rank, Sales, and Market Share by Product Type

- Fujikura/DDK

- Fujikura/DDK – Connector Sales by Market Segment

- Fujikura/DDK Worldwide Rank, Sales, and Market Share by Market Segment

- Fujikura/DDK – Connector Sales by Product Type

- Fujikura/DDK Worldwide Rank, Sales, and Market Share by

- ODU

- ODU – Connector Sales by Product Type

- ODU Worldwide Rank, Sales, and Market Share by

- ODU Worldwide Rank, Sales, and Market Share by Market Segment

- ODU – Connector Sales by Market Segment

- Radiall

- Radiall – Connector Sales by Market Segment

- Radiall Worldwide Rank, Sales, and Market Share by Market Segment

- Radiall Worldwide Rank, Sales, and Market Share by Product Type

- Radiall – Connector Sales by Product Type

- Radiall Worldwide Rank, Sales, and Market Share by Product Type

Chapter 12 – Top 10 Medical Device Companies

- The Top 10 Worldwide Medical Device Companies – Sales 2019 to 2019

- Global Top 10 Medical Device Companies 2017 to 2019 Sales, Growth and Market Share

- Top 10 Medical Device Companies Markets Served

- Global Top 10 Medical Device Companies 2019 Sales and Markets Served

- Medtronic

- Johnson & Johnson

- Philips

- Abbott

- GE Healthcare

- Becton Dickinson

- Siemens Healthineers

- Stryker

- Roche

- Boston Scientific

Appendix

- The Top 30 Worldwide Medical Connector Suppliers

- Global Top 30 Medical Connector Suppliers by Sales with Market Share

- Top 15 Medical Device Market Segments – 2017 and 2024 Sales and CAGR

- Global Top 15 Medical Device Market Segments 2017 and 2024 Sales, Seven-Year CAGR and Market Share

- Top 10 Medical Device Company Sales Projection

- The Top 10 Worldwide Medical Device Companies – Sales 2017 and 2024

- Global Top 10 Medical Device Companies 2017 to 2019 Sales and 2024 with Seven-Year CAGR

This is invisible

Medical Electronics Market for Interconnect Solutions

Focusing on connectors used in the medical electronics market, Bishop & Associates Inc. is pleased to announce the release of their newest research report, Medical Electronics Market for Interconnect Solutions. This 12-chapter, 472-page report examines electronic connectors and cable assemblies used in the medical sector and the equipment these connectors and assemblies are found on. Also examined are the market trends, regulations, and requirements to be successful as an equipment manufacturer and supplier.

A market sector where failure can literally mean the difference between life and death, this report analyzes electronic packaging characteristics unique to the medical market and the types of connectors and cable assemblies that are needed to succeed in the medical space.

OEM equipment interconnect needs are analyzed. The connector requirements are shown for major imaging equipment like CT, MRI, x-ray, and ultrasound equipment. Requirements for monitoring equipment and cabling is also examined, including opportunities for disposable sensor cable assemblies. Special attention is given to the environment where medical connectors are used, including cleaning, disinfecting, sterilization, and rigorous reprocessing techniques used to minimize cross contamination and the spread of bacteria, viruses, and other potentially harmful infections.

The report looks at connectors, cables, and instruments used inside the body, either temporarily during surgery or exams, or long term in implanted devices. The report takes a close look at trends for endoscopes, surgical robotics, dental and electrosurgical equipment which use a variety of reusable and disposable connectors. This latest report also contains a thorough analysis of the Therapeutic market, including a close look at connectors and cables used for respiratory equipment, such as ventilators used to treat patients with breathing impairments caused by the Coronavirus. The report also provides an in-depth review of defibrillators, AED’s, and emerging wearable defibrillator products and the connectors and cables needed to support them.

The report discusses the unique materials, manufacturing processes, and interconnect designs that optimize connectors and cables for medical applications. Included is a comprehensive overview of the top 10 suppliers of medical connectors and assemblies, examining the strategies of these suppliers, including their approach to the market, acquisition strategies, and overall direction in the medical market.

In addition to connector suppliers, a detailed discussion of the top 10 medical device companies is included. In 2019, the medical device market reached $451.6 billion with growth of 5.6% higher than 2018. The market is very fragmented with the top 10 medical device companies accounting for $189.7 billion, 42% of the medical device market. Many other medical device companies make up the remaining $262 billion (58%) of the market.

Overall medical market drivers and trends, as well as political, economic, sociocultural, technological, environmental, and legal factors are discussed and sales and forecast numbers by region, sub-sector, and product type are provided for the years 2017 through 2025.

Download a descriptive brochure here