Computer Server Market Trends and Connector Use 2020-2030

| Report Number: P-410-21 |

Price:

$3250.00

|

| Publication Date: May 2021 |

This is invisible

Computer Server Market Trends and Connector Use 2020-2030

Bishop & Associates research report, Computer Server Market Trends and Connector Use 2020-2030, explores the server market. The report discusses the current trends driving server growth and the manufacturers participating in this growth. Also examined are the connectors used in servers and which connector types will experience the most growth, and which will slowly be phased out.

- How has the server market changed over the last decade? How is it anticipated to change in the next decade? Which regions have prospered from this growth and which regions have seen business decline?

- What connector dynamics influence the server market? What role will photonics take in the server market of the future?

- Which server manufacturers are anticipated to show the greatest growth from 2020 to 2030? Which server manufacturers are anticipated to lose market share?

- Which connector types are most predominate in servers? Is this anticipated to change as server architecture changes?

This is invisible

Computer Server Market Trends and Connector Use 2020 – 2030

Table of Contents

Chapter 1 – Overview

- 1.1 Overview

- Current and Future Paradigms

- 1.2 Background

- 1.3 Key Players in the Server Market

- 1.4 Connector Input

- Server Application Challenges 2020-30

- Situation Analysis

- Future of Key Connector Types

Chapter 2 – Server Manufacturers

- 2.1 Server Manufacturers Overview

- Hyperscaling Drives Server Purchases

- Table 2.1 Server Market 2019-20 Dollars, Units, AGR

- 2.2 Server Companies Today

- 2.3 Market Share

- 2.4 OEMs

- HPE

- HPE Revenues & Units Shipped

- Comment

- Dell Technologies

- Dell Server Product Line

- Dell Revenues & Unites Shipped

- Comment

- Inspur Electronics

- Inspur Revenues & Units Shipped

- Lenovo

- Lenovo Revenues & Units Shipped

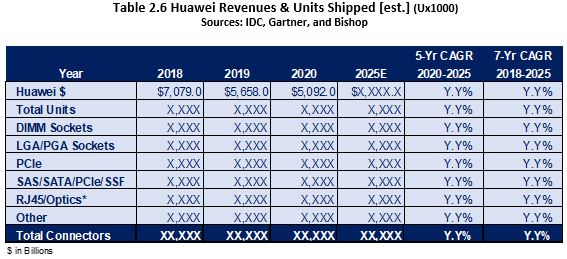

- Huawei

- Huawei Revenues & Units Shipped

- Other Server Makers

Chapter 3 – Connector Use in Data Centers

- 3.1 Overview

- Table 3.1 Hyperscale Data Centers 2010-30

- Table 3.2 Number of World and Regional Data Centers 2015-30

- Table 3.3 World Connector Use in Data Centers 2020-30

- Table 3.4 Connector Use in Data Centers 2020-30 Using Trend Line Analysis

- Table 3.5 Estimate World Hyper Scale Data Centers and Connector Use

- Connector Trends

- 3.2 Key Components in Data Center Applications

- 3.3 Chapter Summary

Chapter 4 – Forecast of Server Markets and Dynamics

- 4.1 Overview

- Table 4.1 Server Connector Market by Regional Consumption 2020-30

- Table 4.2 Server and Connector Market by Regional Consumption 2020-30

- Table 4.3 Server & Connector Market by Regional System Assembly 2020-30

- 4.2 Notes and Observations

- Server Supply Chains

- 4.3 Author’s Article

- Hyperscale Data Centers: The Future of Computing and Driver for Photonics Interconnect?

- Objective of the Article

- A Photonics Research Study

- Photonic/Electronic

- The Need for Onboard Optical Interconnect

- China & the World Going Forward

- Current Situation:

- Chinese

- So Now?

- International Trade Possibilities Beyond China:

- Vietnam

- Malaysia

- India

- Americas

- Europe

Chapter 5 – Connector Industry Landscape

- 5.1 Overview

- 5.2 Industry

- Estimated Worldwide Server Usage in Units

- 5.3 Top 5 [+2] Server Interconnect Suppliers

- Intel

- TE Connectivity

- Molex

- Foxconn

- Amphenol

- LOTES

- Luxshare ICT

Chapter 6 – Conclusions and Comments

- 6.0 Conclusions and Comments

- Silicon Photonics

- Introduction

- Technology Challenges:

- Technologies for Integrated Photonics in the Data Center

- Potential Technology Barriers

- Interconnect Technologies

- Summary

This is invisible

Computer Server Market Trends and Connector Use 2020 - 2030

This six-chapter, 112‐page research report provides detailed information on the server industry, server manufacturers, and connector usage in the server market.

Server connectors are precision-engineered, macro and miniature pin, pad, or spring contact connectors that are designed to provide secure connections: microprocessors, memory, network, storage, power connections on printed circuits, chassis, IO cables, and in 40G-100G-400G Ethernet. They are used in multiple server designs from one to 8U and attached to local and long-haul telecom networks which will eventually carry Zettabytes of data. [1 billion TBs]. Injection-molded connectors are used in HVM server applications, but there are also metal-housed connectors, including those that house 40G and above IO ports, including fiber optics. Mating cycles range from 10-100 for production server connectors and sockets and 100,000+ for test and burn-in sockets for DRAM, Flash and CPUs.

Server connectors run the gamut from Processor and DRAM Memory Sockets to HDD/SSD card edge to PCIe, power and various IO connectors. IO Connectors include RJ45, USB 3.0, VGA, LC and MPO Fiber. The motherboard may include a variety of these.

The server industry is undergoing another paradigm shift from the more predictable OEM-dominated market to one where multiple-players are vying for control, including formidable Chinese suppliers and Taiwan ODMs. The related PC market was expected to continue sub-par results but rebounded with double digits in late 2020 as a direct result of COVID. Server manufacturing is up for grabs between OEMs, ODMs, and Data Centers: DAAS providers [Data-As-A-Service, e.g., Amazon Web Services]:

Download a descriptive brochure here